Hey everybody. Today I want to talk to you about the unprecedented debt levels incurred by the sovereign nations around the world, lead by the United States. We hear a lot about Greece and as well we should. Greece is bankrupt, insolvent, and has all the consequences, social unrest, government upheaval and default on the bonds and so on and so on. While the same thing can happen in the United States given the huge debt levels incurred by the government at the federal level, not to mention the state levels and some of the municipalities. So now we have the total public debt in the United States approaching 100 percent of the GDP, at $15-$16 trillion, increased annually now by $1-$1.5 trillion. That’s the annual budget deficit. Something that tax increases can’t even make a dent in.

So we have exponentially increasing debt, which can only end badly. Now there is no way that debt will ever be repaid. It’s impossible. If you just do the arithmetic, you could double tax rates and it wouldn’t help, it wouldn’t really make a dent.

You can cut back on programs, but it’s too late. The debt has run away.

The way the politicians will resolve this as they continue to kick the can down the road, they have no political will, no backbone to act as adults and solve this problem. So their solution is to ignore it. What will happen is a consequence is interest rates will go up, driven by double digit inflation. That is the consequence of this runaway debt. While no one thinks that we’re looking at high interest rates today given the Feds assurance that rates will remain low for the next couple of years, you can bet that the consequence of all of this debt will be extremely high unprecedented inflation which will then drive the interest rates. That means the value of your dollar and Euro are going to continue to collapse, so that the price of milk and bread is going to go up big soon. It’s already going up, but it’s going to accelerate.

So what do you do to safeguard your portfolio, safeguard the purchasing power of the dollar or the Euro? One hedge is to buy precious metals, silver and gold principally. One of the problems with buying silver and gold is they are very volatile markets. So if you had bought silver at $50 an ounce here not too long ago, it’s now below $30 an ounce, so you’d be looking at a 40 percent loss. Who wants to do that?

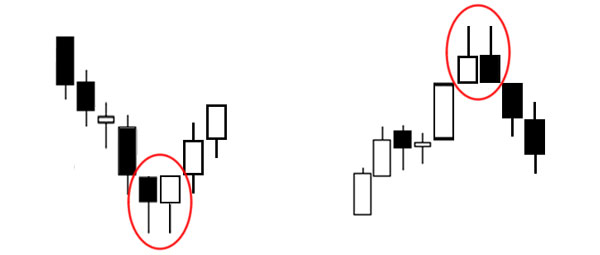

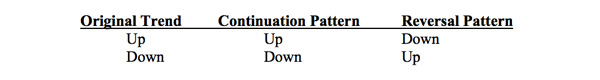

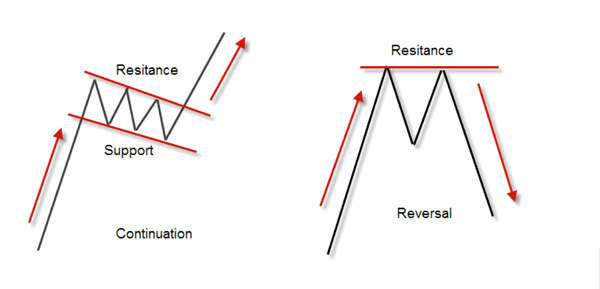

Now, I think one of the ways you hedge this inflation risk is yes, with precious metals, but you learn how to trade the precious metals. You don’t just buy them and hold them, because who wants to run the risk of a 40 percent loss? If you learn how to trade them, you can have the potential to ride the trend up when it’s going up like silver when it drove to $50, ride that trend up and then get out, after it peaks and go to cash. Then wait for the new uptrend to begin and get involved again. That way you are hedging the inflation risk in an intelligent way without incurring additional risk by buying and holding the precious metals.