Gold, Gold, Gold, what to say about gold? This week has been a bit of a challenge with gold as we have seen it move up, down and sideways through most of the week. In the end, with the news from the EU Summit, we saw the price jump up sharply to close near the $1600 level. Right now, as with many of the other markets, we are seeing much volatility and non-deliberate movements. This can make things a bit more difficult with knowing when to enter a trade. Overall, if things are hard to read it is often times best to stand aside and wait. At some point things will begin to become more deliberate and that is when we want to look for our trading opportunities.

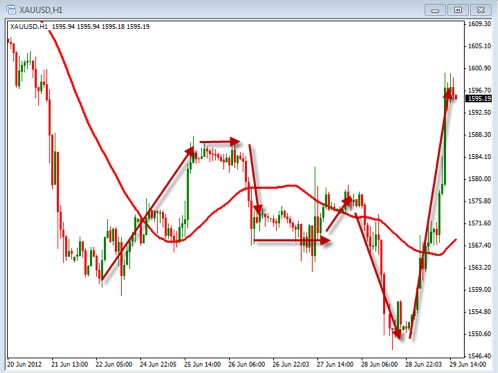

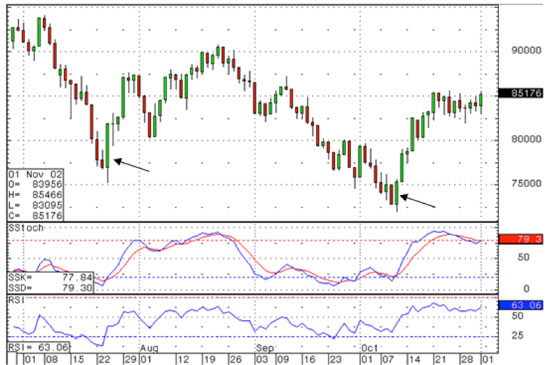

Take a look at the hourly chart above and notice the arrows the have been drawn. This is a good example of how this week traded. You can see the up, down and sideways moves that have occurred, followed by the end of week move up. Ideally, we want to see a nice consistent and deliberate moving price action in order to look for good trading opportunities. Keep that in mind when looking for entries. In addition, holding positions over this weekend may be a bit more risky as any new that may come out could push the price of Gold up or down quickly and cause the charts to gap up or down.

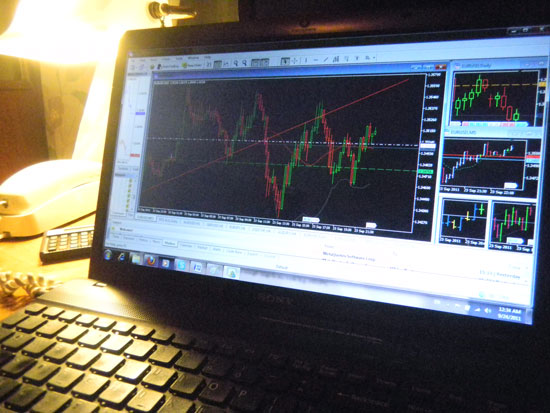

Now take a moment to evaluate the daily chart shown above. Notice two things – the trend and support/resistance. Here we have drawn a downward trend line that has been acting as an area of resistance and may continue to do so in the near term. This resistance is currently sitting around the 1619 level. We also have the 40 period SMA that is currently moving down. Both these things point to a bearish Gold trend. In order for this bearish trend to change we will need to see the Moving Average point higher and the price breaking above this resistance line. If that happens we will change our stance to bullish from bearish and look for opportunities to buy Gold. Until then we need to look for shorting opportunities with this chart. You should also notice that the volatility is similar to what we saw on the hourly chart above in that there is very little deliberate movements occurring.

In the end Gold continues to be volatile and non-deliberate in its moves so exercise caution when placing your trades and use good solid risk management rules in those trades. It’s not all about trading, it’s about trading well. Look for the trend to become deliberate prior to placing your trades.