Every time we begin our analysis of Gold or Silver we need to begin with looking at the charts. No matter how much we want or hope for Gold or Silver to go up or down we won’t be able to move it on our own. This means that we need to be able to evaluate the movement or potential movement based off of what we see happening on the charts. If we begin hoping that something is going to happen we begin trading in the realm of fantasy. This fantasy trading is no way to develop a consistent and deliberate way to trade. Ultimately we will end up loosing our money to the markets. So, if we cannot rely on hope or want, what can we rely on? Well, the answer is that we need to base all of our analysis on the evidence that is presented on the charts.

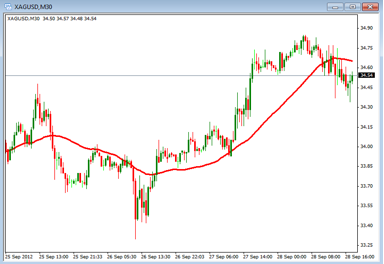

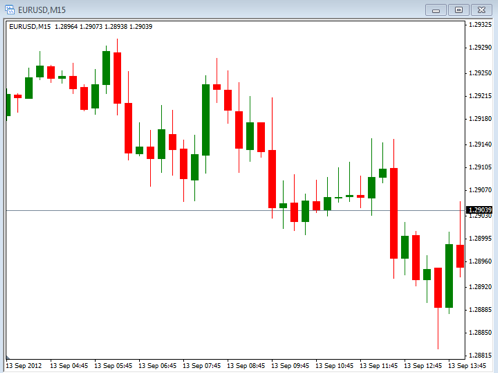

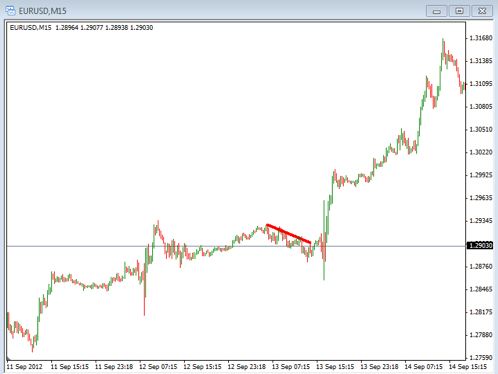

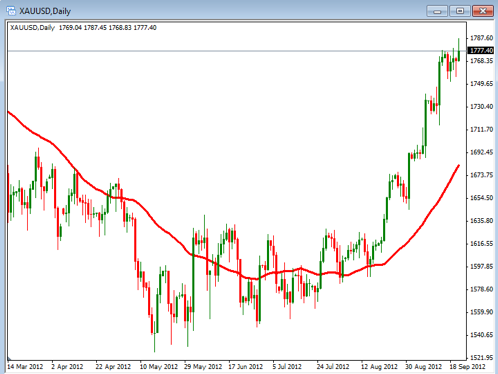

This chart evidence comes in the form of price action and any indicators that we may be using. Remember, price action is the key. If price is not moving then we cannot assume that it will move in any one direction. We need to wait until we see it move prior to making any decision on trading. Trading what we see and not what we think is the proper way to analyze our trades. Let’s take a look at the two charts below. The first one is Gold and the second one is Silver.

As we look to identify what is happening on this chart we need to first look at the Trend. In this example we can clearly see what is going on. Not only is the price moving up and making higher highs, but the 40 period Simple Moving Average is moving up while the price is above it. So, the evidence that we see should direct us to the conclusion that the trend is up. That means that we should only be buying Gold. If you start adding your thoughts into the analysis, such as “it can’t go any higher”, then you are not trading the evidence. In fact, you are trading counter to what the chart is showing us. It may be true that it won’t go any higher, but we won’t know that until the chart shows us that it is now going down. Remember, trade what you see.

The chart above is the 30 min. chart for Silver. Notice that the chart was trending up but has recently moved below the 40 period Simple Moving Average, which has also turned down. So, even though the trend was up, we now have enough evidence on the chart to tell us that the price should be considered bearish (at least for now).

In the end, we need to really know how to analyze a chart by focusing in on what we are actually seeing, not what we want to see. By focusing in on the evidence we can begin to develop the confidence we need to become successful traders. Take some time to practice analyzing the charts based on the evidence you see and write down your conclusion to what you are seeing. Later go back and review it to see if you were analyzing it emotionally or if you were doing it properly.