Today we are going to spend some time talking about how we define the trend of the chart. Regardless of the time frame we are looking at we need to be able to tell the direction that the price is moving. The trend can be defined in terms of the long, intermediate and short time frames. If we are trading the short time frames we still want to know the longer term trends. The longer the trend, the stronger price movement can be expected. If we are trading counter to this longer time frame we need to be aware that we are doing so.

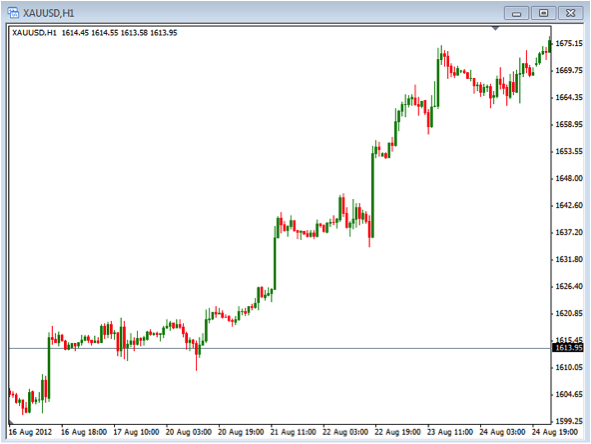

The first thing we need to do is have some criteria we look for in order to define it the trend is up, down or sideways. As an example I will present the following as a suggestion of how to define each of these trends. We will use the chart of Gold on the daily time frame for our example:

In order to define the trend as moving up we are using the 40 period SMA. When this SMA is pointing higher like we see here, the trend is up. In order to confirm the trend we want to make sure that the price is also above this average. Knowing that the price and moving average are sitting in this position we can have confidence that the trend has been established as up. Once the trend is established as up we will be looking for opportunities to buy.

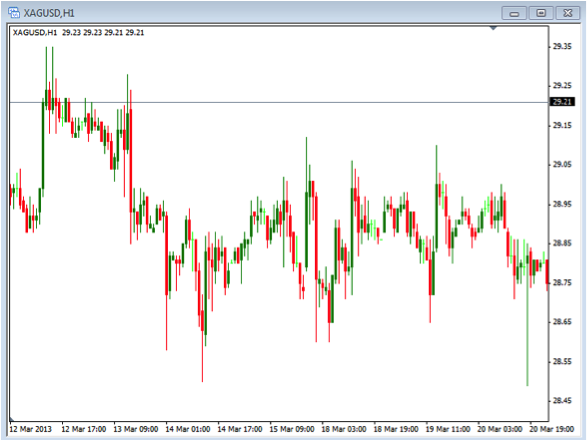

Downtrend:

In order to define the trend as moving down we are using the 40 period SMA. When this SMA is pointing lower like we see here, the trend is down. In order to confirm the trend we want to make sure that the price is also below this average. Knowing that the price and moving average are sitting in this position we can have confidence that the trend has been established as down. Once the trend is established as down we will be looking for opportunities to sell.

Non-trend:

Should the alignment be different than what was described for the uptrend or downtrend we will consider it a non-trend. In this example above we can see that the 40 SMA is moving lower but the price is above the SMA. This is out of alignment for calling it a down or uptrend so we will look at it as a non-trend situation. In this situation we would not take a trade until the proper alignment happen for the up or down trend.

When we are looking to take trades we want to make sure we know what the trend is for the time frame we are trading as well as the longer time frame. This puts us in the best possible position to allow our trade to move in the direction we want it to.

Take some time to review how you determine what the trend is. Make sure you outline your rules and write them down so you can follow them when looking at your charts.