In today’s article we are going to discuss the process of using longer-term charts in our decision making process. By using longer-term charts we can see the bigger picture of how the market is moving and use that to understand the direction we should be trading on the shorter-term charts.

If we become too myopic in our view of the market we are limiting our potential gains. Being myopic means that we can be nearsighted or shortsighted in our view. Another way to describe this is to say we are not seeing the bigger picture. As we take a “macro” look at what is happening we see this bigger picture and can use that to help us in knowing what to do on the shorter time frames.

As we incorporated longer-time frames into our trades we are simply saying that we want to know where the stronger momentum is taking the pairs we are trading. It should make sense that if we are fighting against this longer-term momentum we are making our jobs more difficult. Just as trying to swim upstream in a large river can be difficult, so is trying to trade against this stronger trends in the market. Longer-term trends tend to last for weeks and months at a time, so if we can identify where these pairs are moving we can jump in and let them move us in the direction it is headed.

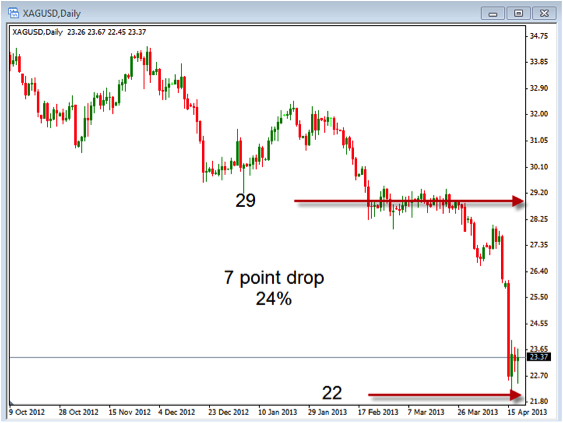

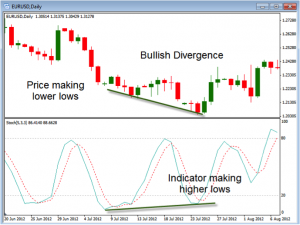

One way to do this is to begin incorporating the weekly charts into our evaluation of the pairs we are trading. In the chart below we are looking at a weekly chart. Notice that we can use just a few things to help us determine this stronger momentum.

In this chart above of the USDJPY, we are looking at the 40 period Simple Moving Average to identify the longer-term trend. If the 40 SMA is moving up while the price is above it we can say that the momentum is more bullish than bearish. Once we have identified this we can use this information to show us the direction to trade on the shorter-term charts.

You can also use the concept of one time frame higher to do the same thing. For example, should you be looking to trade the 15 min. charts, you can use the 30 min. chart to show you the longer-term momentum that is happening. This would hold true for any time frame you were trading. It could be the 5 min. chart with the 15 min. chart as the longer-term chart or any other period you are trading.

Regardless of the time frame you are looking at or the type of strategy you are trading, knowing the direction of the longer time period can help you to better evaluate your trades. Take some time to review how you are using these longer periods and how you might be able to incorporate them better into your current trading plan.

Remember, the longer-term charts can be used to give us the stronger momentum that is happening on the charts. Knowing where they are headed can give us an advantage when we are trading.