Many traders trade on emotions instead of rules, especially when the market is moving quickly and they don’t want to be left behind. Trading without a specific trading plan can be a dangerous habit. Many traders don’t have a trading plan, or even a daily checklist. By contrast, many professionals will prepare for the market day before the market opens.

A good trading plan can be broken down into three important parts:

First, the plan would naturally include a trading strategy or method. Any good strategy should include market entry/ exit strategies depending on the markets traded and current market conditions (stocks, options, Forex, etc.) and the various market conditions.

Second, a trading plan should include a specific set of risk management rules with clear and understandable risk levels. This including position size calculations in order to control the risk with each and every position entered.

Third, any good trading plan should include a regular and repeatable routine. The more consistently a trader follows a set routine the more consistently will be the implementation of a good trading strategy. Several traders have told me recently their biggest problem is not finding a good strategy, but implementing a consistent routine is their biggest challenge. Once a routine is carried out consistently, trading success will become much more likely depending on the market strategy.

A routine is best written down as a checklist so that it is simple and repeatable. Each individual trader needs to adapt a checklist to their individual needs. The checklist below is a potential outline that will get a new trader started. Modifications should be made depending on the trader preferences, type of trading (day trading, swing trading, position trading) and trader experience.

1. Check/read newsletters from paid/unpaid subscriptions from signal service, news, analysis, etc.

2. Check the day’s economic calendar for any scheduled reports and announcements for the day – this part covers the fundamental analysis. You will be checking the expected numbers against reports that will be published during the day.

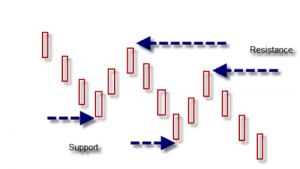

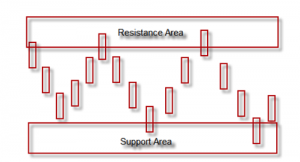

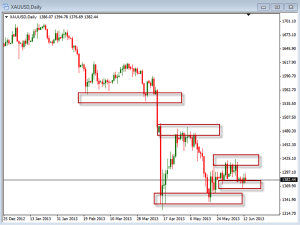

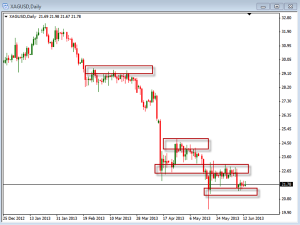

3. Check the charts for price action – this is mainly for a trader who trades using technical analysis. Normally you will check to see if the prices have violated any support/resistance areas. For technical trading, some of the most popular indicators and tools used are:

- Support/Resistance areas (daily, week, month)

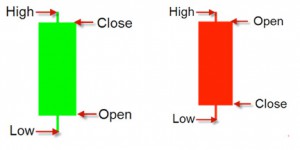

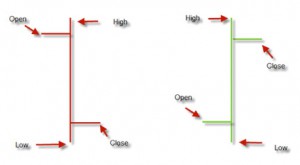

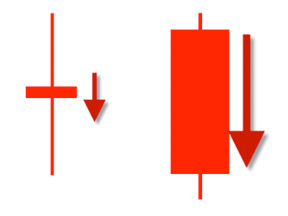

- High/Low/Open/Close and candlestick patterns

- Indicators such as Stochastics, MACD, RSI, Momentum, Volume, etc.

- Fibanacci retracement levels

4. Write down thoughts while going through the checklist – this step is for the trader to write out trading ideas for the day, how much to risk , where you’ll be taking the position, where you’ll exit, and how large the position size you are going to take.

5. After the trading session is over or after the trading day is complete, it is important to document or journal each trade, with entry, exit, profit, loss, risk in trade, justification for entering, etc.

Once you have a good daily checklist that you are following, it is important to use it by following the plan every trading day. This will help us to be much more consistent traders with hopefully more consistent results!

So, If you don’t have one already, make a written trading plan with a simple, easy to use daily checklist, and keep a daily journal of all trades.