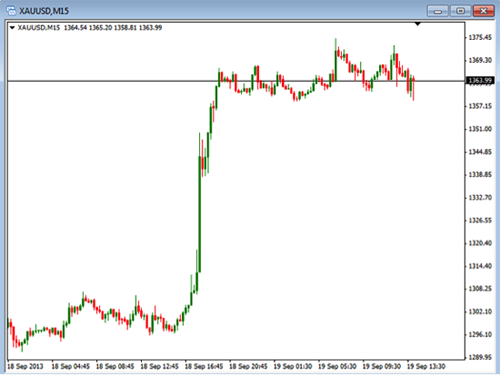

From a conceptual standpoint trading is very easy in the respect that anytime you enter the market you have a 50/50 chance of making money because at some point the market will only go up or down. Finding a good entry point to get into a trade is really not that difficult to do, only enter in the direction of the prevailing trend and allot of traders will wait until specific common indicators such as moving averages are cleared which of course is one of the things that makes them common and also one of the things that makes them get cleared. Losing when trading is also easy because all you have to do is set your protective stop, if a trade goes far enough against you the stop will be reached and you will exit the trade, this is not complicated. The more difficult thing to do is to manage open positions that are moving in the direction of your trade, that are profitable, and that have a legitimate chance of making you money.

It seems as though the longer you are a trader the more the realization sets in that the entry point is very important but the management of profitable trades and their exit points are at least as important and in fact may be more important. Any trader that believes that they can consistently get into a trade at the very beginning of a move and back out at its very end is likely to be very inexperienced. My experience tells me that the entry for many traders is far more consistent than their exits. The reason for this is because to enter the market with any given method there are certain things or conditions that must occur. If A, B, and C happen we place a particular type of entry order however once we enter the market we obviously still must exit preferably with as much of a profit as we can capture.

I believe that one of the most consistent ways to do this is to determine ahead of time how much of a profit are we looking for. Are we looking for a specific dollar amount or a specific number of points or pips or a specific percentage? If we are looking for something specific how do we handle it when the price action comes within a fraction of meeting our profit target and turns around on us never reaching that level again on that particular move? How do we handle it when the price action rockets through our profit target and we see that we could have realized several times the profit that we actually did? When either of these things happens to us are we emotional about it or are we following our rules with no regard to what variables may occur? Will these events cause us to constantly adjust and change our exit strategy or are we disciplined enough to follow our rules?

I have the chance to communicate with many traders on a regular basis with all levels of experience and it seems that most traders exit strategies for profitable trades varies and is largely based on risk aversion. What I mean is exactly how much unrealized profit that is currently in a profitable trade are they willing to risk. Many traders will get very uncomfortable and jittery when their trades are profitable because though they want to maximize their profit they don’t want to stay in too long giving allot of it back if the price action abruptly turns on them. Looking for A, B and C to occur before entering a trade is fine and it actually works however once you are in a trade and you have a specific entry point to deal with getting out when D, E and F occur is much more difficult. The reason is that all we need to have happen for us to enter is that our entry conditions are met regardless of the price level, however, once we have the established entry price our exit conditions will not always occur at a time when our trades will be profitable or to the degree of profitability that we are looking for. This is the reason that our entries can be much easier and much more consistent than our profitable exits.

Some traders will use a consistent number of points, pips, dollars or percentages and some will use a floating stop letting the price action dictate when they exit. Regardless of which theory is used to exit a profitable trade what I notice is that even the best exit strategy works a good amount of the time but it won’t work all of the time which is what can cause us to make changes and adjustments that for the most part are probably unnecessary. Once you determine which exit strategy works best for your style of trades and trading use it consistently, if it is a good exit strategy it will produce consistent winning trades while limiting the losses on the losing ones.