In a market that has been as volatile as we have been experiencing, it is often times good to use some additional confirmation in order to look for trading opportunities. Today we are going to look at how the Fibonacci lines might be able to help us look for these opportunities.

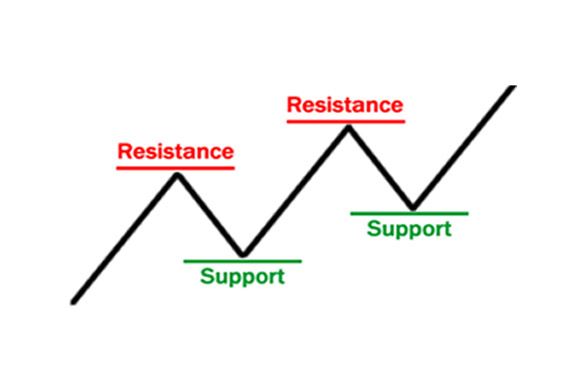

Fibonacci retracement lines are oftentimes used to help us see where the price might find the next level of support or resistance. These retracements are looked at by many traders and can be a significant area to look for change. A bounce-off or breakthrough of these areas can be a great opportunity to enter a trade.

The idea of using these retracements is to draw a line at the beginning of the trend and stopping at the end of the trend. The lines will be placed on the chart indicating where a retracement may be located. Once the level is reached, you will then look for opportunities to enter a trade.

Another way to use the lines is to look for areas where we might place our stops and our targets. These lines will give us a visual as to where we might want to place these exit points.

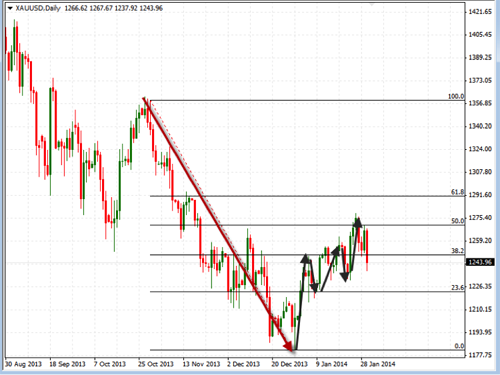

Take a look at the chart below to see an example of Fibonacci retracement lines on the chart of Gold. You can see the red line, which indicates the downtrend. This is the trend where we will draw our Fibonacci line. The line is drawn from the beginning, which is the top of the red line down to the bottom of the rend line. You can see that there are several lines that are placed in the chart showing the various levels of retracement based off of the Fibonacci numbers. The bottom line is the zero line, which represents no retracement at all. The next line up on this chart is the 23.6 level, followed by the 38.2, then the 50, 61.8 and, finally, the 100% retracement line. At each of these levels, you will see the possibility of the price changing direction. If you see a bounce down from these levels, you will have an opportunity to short the chart. If it breaks up through, you have an opportunity to buy. Either way, you will want to look at these areas for possible trade decisions.  Regardless of your rules for entering into a trade, the use of Fibonacci retracements might be a good addition to your trading. We all know the importance of using trends and identifying support and resistance areas, so this indicator is a natural extension of that concept. As we identify the trends, we can draw the Fibonacci lines and as we see the lines we can use them to help us better identify these key support and resistance areas. Take some time to review this indicator and practice using it on your charts in conjunction with your current rules. You will then be able to see if they can help support your trade decisions.

Regardless of your rules for entering into a trade, the use of Fibonacci retracements might be a good addition to your trading. We all know the importance of using trends and identifying support and resistance areas, so this indicator is a natural extension of that concept. As we identify the trends, we can draw the Fibonacci lines and as we see the lines we can use them to help us better identify these key support and resistance areas. Take some time to review this indicator and practice using it on your charts in conjunction with your current rules. You will then be able to see if they can help support your trade decisions.