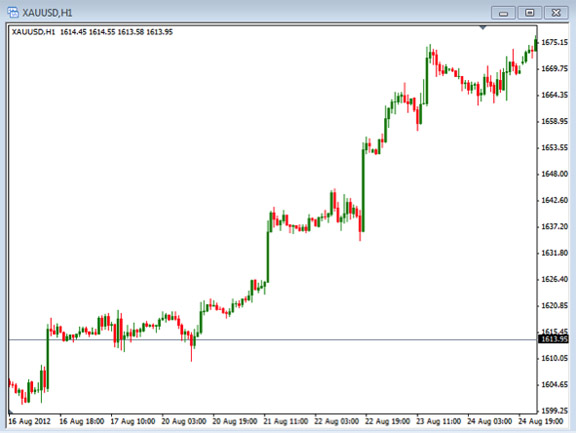

Today we are going discuss a bit about trading when the market is moving in a deliberate fashion. In order to know if we are trading in a deliberate market, we first need to define what a deliberate movement looks like. This should be fairly obvious, but we will try to define it anyway.

Deliberate markets are ones that the price action avoids big price swings or flat price action. What we are looking for is a market that avoids trading in the extreme ranges of price action. If it is too flat, then the setups have a hard time developing. If it is too volatile, then the setups become harder to identify. Deliberate movements are those that fit in between these two extremes.

Non-deliberate markets have price action like we described above. When we are trading during times of big price action we will see candles that move up or down quickly, followed by quickly reversing moves. As you can imagine, if the price moves too fast, we will have a difficult time entering and exiting our positions. On the other side of the extreme, we have flat markets that seem to just move sideways. These types of movements can be frustrating because as soon as we get a setup the trade goes flat.

Now that we have defined what a deliberate market is and is not, we can know what we need to look for on the charts. When looking for deliberate markets, we should focus on finding price action that is smooth and consistent in how it moves. Just like when trying to identify the trend, we want to find price action that swings from high to low with the extreme moves. As the price deliberately moves to new higher highs and higher lows, we will be looking for buying opportunities. As the price deliberately moves to new lower highs and lower lows, we will be looking for selling opportunities.

As we look for deliberate moving markets we need to realize that we are not looking for perfection, just nice consistent moves. As we look and identify these types of markets, whether we are trading gold, futures, stock or currencies, we will be placing our trades in the best possible situation to profit from our trades. If we become too anxious and jump into a trade without evaluating the deliberate or non-deliberate movements, we will never know if we are getting in at the best times.

Sometimes it can be difficult to tell if the market is really deliberate or not, so take some time to practice looking at and analyzing your charts in order to become more comfortable with making the decision. This will give you more confidence and place you in the best possible positions to be successful with your trade. Although we may never find the perfect market movement, we certainly can find the times when it is not perfect. Avoiding these times will keep you on the right path for trading the best markets.