A common question that I am asked is, “What type of investments should I choose?” or “What is the best market for me to be in?” There is a multitude of investments available that range from the very safe and, borderline, boring, to the very risky, maybe even to the point that many people wouldn’t be able to sleep at night if they had their money in them. Choosing the investment type that is the best, or the most appropriate for a person, will come down to a lot of factors, the least of which is the nature of the investment itself. There are no secrets around the risk level of investment types, so gaining that knowledge really isn’t that big of a challenge, but what can be a challenge is figuring out what type of trader or investor you are or what type you want to be. Once you determine this, matching up an investment to conform to your personality is relatively easy.

The specific investment that will meet a given investor’s needs is based on a lot of factors, most of which have to do with the personality type and the goals of the investor. Some people are aggressive by nature, so they may have a higher risk tolerance than others that may be more passive by nature. Some people want to hold on very tightly to their money, not letting it loose enough to earn a decent return, while others will allow their money more freedom so their investment choices may have more opportunities to work for them.

A common occurrence is when people feel the need to be very aggressive with their investment choices for various reasons. Some people may feel stress because they have not saved very much money, while others may be experiencing the stress of not having enough cash flow to comfortably live off of each week or month. It is not uncommon for people in these situations to ask me if they can take the $2,000.00, or whatever small amount of money that they currently have, and trade with it so they can earn a few thousand dollars per month by trading options or by trading in the Forex market. I hate to bust their bubble, but I do – I typically tell them that, though anything can happen, expecting to earn nearly a 100% return every month is simply not a realistic expectation. In this case, regardless of their personality type or what the best investment choice may be for their current situation, they are willing to do almost anything, including risking all of what they currently have by participating in investment choices that they otherwise would likely never consider.

Choosing the right investment type can be a very simple process if you identify your reason for investing or what your specific need or goal is. Some people have great cash flow, but no assets, so letting cash build up and grow over time is their primary objective. In this case, they will likely choose longer-term, growth-oriented investments. Making this type of investment choice is logical and makes a lot of sense, but a problem is when people make investment choices out of panic or desperation. Under the same scenario, if the person with the good cash flow, but no financial assets, were two years away from when they wanted to retire, and they are just thinking about their future, they may look at some more aggressive types of investments, which may or may not work out well for them.

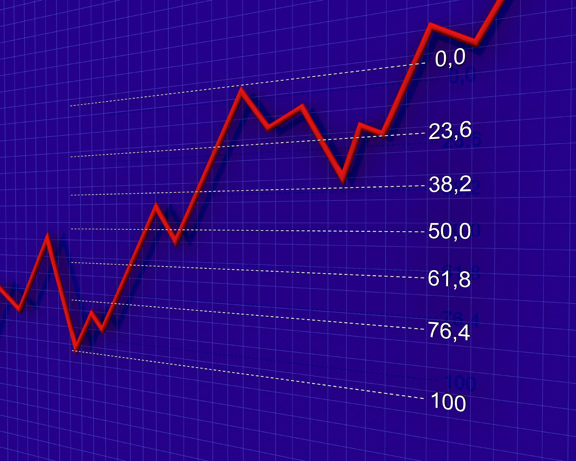

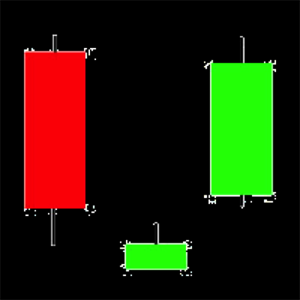

Another thing to consider, which it seems as though a lot of people overlook, is the time that must be spent on certain types of investments. If you do not have time to sit in front of a computer, looking at charts a good portion of the day to trade stocks or to trade on short-term charts in the Forex market, or if looking at charts is very boring to you, don’t do this. Don’t fool yourself into believing that you can, or will, spend the time that is required when you know it’s a lie. When it comes to trading and investing, one investment type definitely is not a good fit for everyone. So be honest about what you can and cannot do and what you are and are not willing to do. Many markets and investments take a lot of time to learn how to effectively use them and if this is something that you know you won’t do, simply choose more passive types of investments that don’t require much of your time to maintain. Investing can be a great thing, but forcing yourself to use the wrong investment vehicles will usually end up being nothing more than just a waste of time and can end up being very costly.