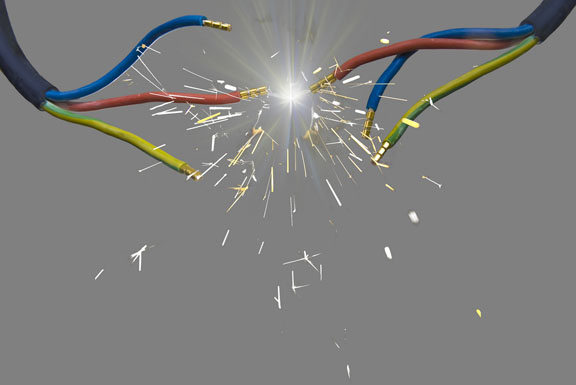

In the recent market volatility, many traders are confused and are trying to second-guess their strategies. Emotions are running high. When I ask traders how they are doing, some are curtailing there trading, some are in cash and have stopped trading all together. This is understandable; however, it is impossible to know when the next best trade will be. So letting emotions control our timing could keep us out of potentially good trades. The main emotions that traders deal with are fear and greed.

FEAR

Fear is the emotion that will keep us out of the market or delay market entry. Here is an example of how this plays out over and over. A trader is fearful and nervous about the market and may have had one, or even several losses, thereby heightening the emotion. So when a trade setup occurs, the natural tendency for many traders is to hesitate and pass on the trade. What we don’t know is how that trade will play out. If we have a good system with good probabilities, we need to trust the setups, as the next trade may be the best trade of the week, month, or year.

The other scenario is, because of fear, a trader hesitates to enter the trade when the setup occurs, then the trade starts to do well, the trader then jumps into the trade late, just to have a good trade go bad because the trader didn’t enter according to the rules when the original setup occurred.

How do we overcome the emotional response of fear? The best way to deal with this is to go ahead and take the setups that occur and make sure you are controlling your exposure to market risk. Risk management is the key to not letting a bad trade get out of hand and turn into a bigger problem, which can only makes your psychology worse.

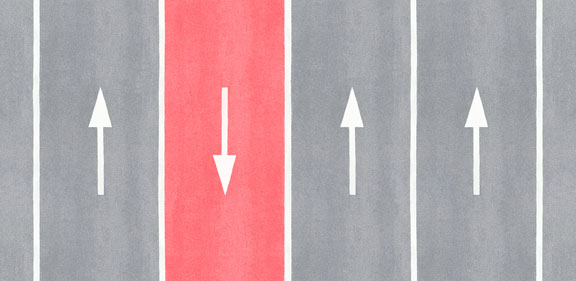

GREED

The second emotion that can potentially throw a trader off is greed. Greed can play out in a number of ways. For example, earlier I discussed the scenario when a trader hesitates to get into a trade because of fear that the trade may be a loser. But when the trade starts to work out or move in a profitable direction, greed is the trigger that makes a trader want to jump in late and not miss the good trade. This is a tendency that must be overcome. It would be like someone who goes to the train station to catch a train and the train is sitting there ready to board, but the potential passenger is unsure about its destination and once the train moves out and leaves the station, the passenger tries to run down the tracks to catch it. This seems silly; however, that is actually closer to what happens, that trade often doesn’t work out well because of the late entry. The best way to counter greed is to not “chase” trades and to keep your position size at a proper level. The best thing you can do is to reduce your position size. In a good market, supersizing your positions because of greed can also lead to larger losses if the trade doesn’t work out as expected.

Remember – it is very important to control your emotions to become the most disciplined trader you can be. This is possible by using good risk management with stop losses and keeping your position sizes smaller during more volatile market conditions.