In the world of forex trading you will find all kinds of various ways to take trades. Many of these way use specific indicators to identify these entry and exit points. Some of them even use multiple indicators to identify these points. The problem with some of these is that they become so confusing with all the indicators that they are not very effective for most traders. Another problem of multiple indicators is that they often times take our attention away from the most critical part of trading. This most critical part is to look at the price action that is currently happening. Price action should be the most important thing we look for and indicators should be secondary to this. By keeping our priorities straight when looking at charts we will be able to better use indicators along with the price action.

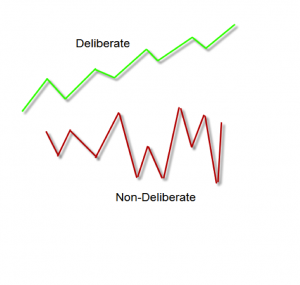

Take a moment to review the two charts below.

This first chart has multiple indicators being uses. Notice that the chart if fairly cluttered and a bit confusing to look at. Now this does not mean that you cannot use multiple indicators but you need to make sure that they do not take the place of simply looking at the price action. The indicators should be able to improve our entries based on price action, not replace the price action.

Now, take a look at the chart below and notice that there are not any indicators, just a clean and clear looking chart. This chart allows us to see what the price is doing and to be able to identify where an entry may occur without the indicators cluttering up the charts. Once we have identified a possible entry we can then add indicators to support our decision to enter or exit a trade.

By knowing and using this order of importance when looking for an entry, we can focus on what is the most important part of trading – price action.

Once we become familiar with the price action and begin to rely less on indicators, we can begin to see things as they really are. Indicators often times give us a false sense of security and can lead us in the wrong direction. As you start to see the price action you will begin to pick out specific price patterns that can be used in your trading. These patterns are generally created as the trend is established and the areas of support and resistance are defined.

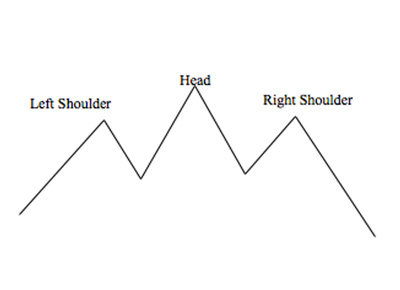

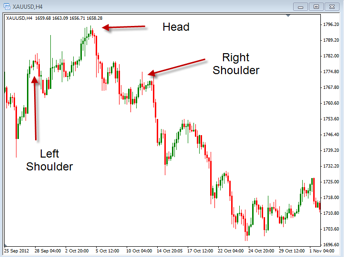

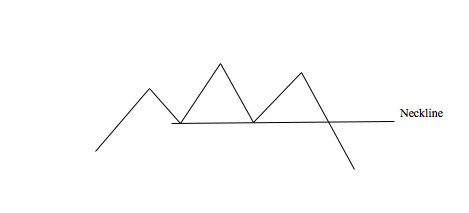

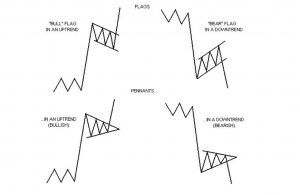

Price patterns are simple ways to learn to enter and exit trades. There are many types of price patterns and include continuation and reversal types. The one type I want to look at today is the price pattern called a triangle. This is a simple pattern and one in which every trader should be familiar. Take a look at the chart below.

Notice that the lines of support and resistance here are pointing towards each other forming what looks like a triangle. This converging of support and resistance is created as the price is consolidating in a tight range. This consolidation will, at some point, break out of the area. This move with be either above the resistance or below the support line. The entry would be to look for this breakout and to enter either long or short, depending on the direction it moves. A stop loss is place at a point back inside the triangle, in case the price decides to reverse.

Simple price patterns like this can be a clear way to identify your entry and exit point when trading. Take some time to simplify your trading by focusing in on price action and avoiding too many indicators, then look for price patterns such as triangles to enter into trades.