Ever since Facebook decided to ban cryptocurrency outright from its advertising platform, a complex relationship blossomed between the social media giant and digital currencies.

To curb phishing attacks against its users, Mark Zuckerberg updated Facebook’s advertising policies on January 30th, 2018 to prohibit ads that used “misleading or deceptive promotional practices” – including advertising for ICOs or anything else crypto-related.

It was the first time a major ad network blacklisted crypto entirely, and a somewhat perplexing move as it came shortly after Zuckerberg said himself that he was intrigued by the decentralized nature of digital currencies, wanting to study them further.

In the beginning, the ban was “intentionally broad” according to a statement released by Facebook, with the goal of allowing “legitimate” crypto-related advertisers to eventually re-join their platform down the road. Many critics of this controversial new policy slammed Facebook, arguing that Zuckerberg had whitewashed the entire industry – permanently damaging its reputation in an attempt to stop a few bad apples.

After all, if Facebook (the most popular social media website in the world) banned crypto ads, why would the average person want to keep their hard-earned cash in digital currencies?

Zuckerberg fired the first shot, with Google and Twitter falling in line shortly-thereafter, banning cryptocurrency ads as well.

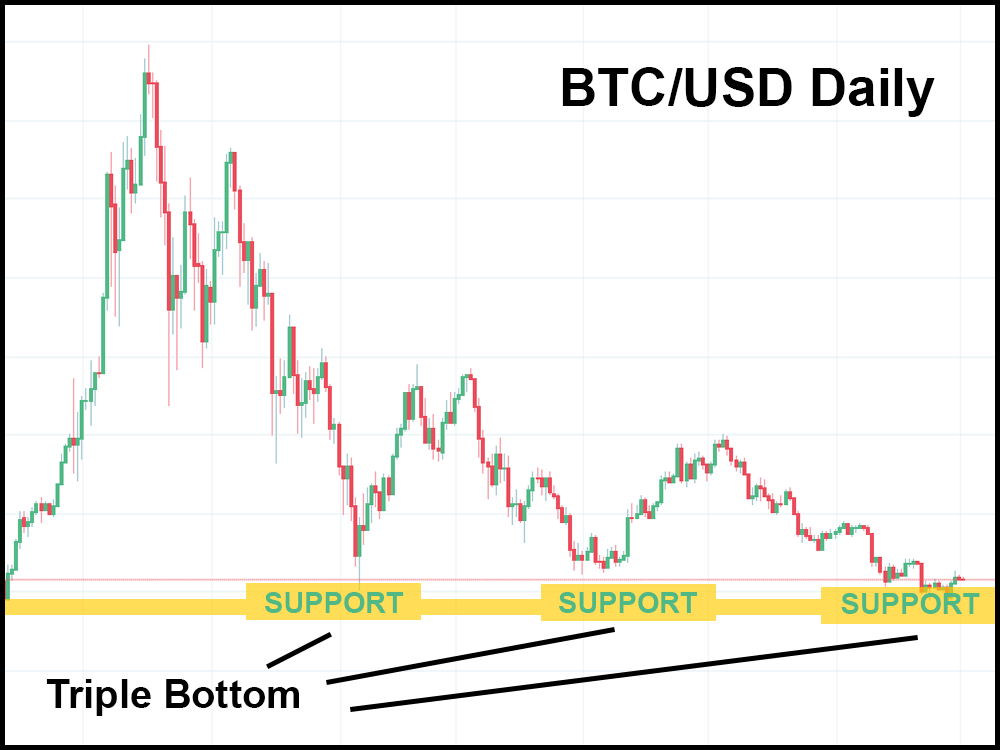

The market reacted poorly, and Bitcoin dropped roughly 20% over the week following Facebook’s new ad policies – eventually falling below $8,000. Ethereum suffered its share as well, dropping sharply below $600 after the Google and Twitter crypto bans. The market was utterly deflated from the news and carried this negative momentum all the way into April when Bitcoin finally bottomed out for the second time in 2018.

Since then, Bitcoin (and the rest of the market) has had its ups and downs, looking somewhat lost ever since being branded as unsuitable for the major ad networks.

That all changed early last week, however, when Facebook surprisingly announced that it was changing its stance on cryptocurrency-related ads:

“Starting June 26, we’ll allow ads that promote cryptocurrency and related content from pre-approved advertisers. But we’ll continue to prohibit ads that promote binary options and initial coin offerings.”

Bitcoin continued to drop despite the announcement but eventually turned around on June 29th, after bottoming out yet again for the third time this year.

As a technical trader, this really stood out to me, because a “triple bottom” may be one of the most reliable indicators for a trend reversal that you will ever see.

When Facebook banned crypto ads in January of this year, Zuckerberg cited phishing scams as the primary reason for it. Users were clicking on fraudulent ads and entering their login information into fake websites, losing control over their accounts in the process.

It’s great that Facebook was proactive in preventing phishing scams, but while their hearts may have been in the right place, they completely missed the mark when it came to implementing a solution.

Facebook acted like phishing scams never existed before crypto came around and that it was a problem specific to digital currencies. In reality, every industry and niche is subject to fraud – cryptocurrency is not special at all in that regard.

All the major ad networks have terrible quality control when it comes to reviewing new advertisers, and routinely let fraudsters onto their platforms. It’s just that these days when someone gets scammed, it’s not just a credit card being stolen – it could potentially be thousands (or even millions) of dollars in digital coins.

So I don’t buy the reasoning behind Facebook’s crypto ban. They could have just gotten stricter with their ad approval process, but they didn’t. Instead, they chose to institute an industry-wide ban.

And I don’t think it came from a place of fear or helplessness. In my opinion, Zuckerberg’s move was a strategic, preemptive strike in the upcoming war for crypto ad revenue.

Immediately after Facebook barred crypto ads, two other major (competing) ad networks followed suit – Google and Twitter. With nowhere to advertise, crypto-related businesses began drying up. The market was tumbling anyway, and with crypto ad revenues shrinking considerably since the holiday season, Facebook had no problem turning away would-be advertisers.

In fact, I believe that it was a small price to pay for what was at stake when the market eventually came back around – something that Facebook had been counting on since earlier this year.

Because when Bitcoin triple bottomed back in late June, Facebook finally got the signal that it was looking for – the technical evidence that they needed to confirm that a trend reversal was coming.

So, with Bitcoin about to make a move back upwards, Facebook lifted the ban, contributing to a slight recovery for Bitcoin in the days that followed – kickstarting a renewed interest in digital currencies and their related products.

As the only ad network currently allowing crypto-related ads, Facebook has positioned itself to potentially monopolize the niche’s ad revenue – driving up demand (and revenues) significantly.

Google and Twitter will likely lift their bans as well, allowing crypto back onto their networks in the coming weeks and months, but by being the first to do it – Facebook may have just cemented itself as the “go-to” ad network for crypto, capturing the lion’s share of the ad revenue in the process.

Mark Zuckerberg and Facebook may be happy to play dumb, acting like they just had a change of heart after nearly half a year of self-reflection…

But I suspect that there was far more to it all along from the beginning.

Facebook banned crypto ads while the market was cooling off amid dropping ad revenue. Now that things are finally heating up again, Zuckerberg has positioned his company to be the prime advertising partner for the crypto industry.

An industry that some experts predict will be worth as much as $20 trillion in a matter of years.

So, while Bitcoin and the rest of the crypto market may still be down on the year, remember that major companies and billionaire investors are starting to make their move on digital currencies. In doing so, Zuckerberg may have accidentally shown his hand too soon by lifting Facebook’s ad ban.

The pieces are in place for the next big crypto rally, and the major players are ready to roll the dice.

The question is, are you?