The Stochastic Oscillator is a technical indicator that looks at the closing price of the currency pair and compares it to the price range over a specific period of time. As this time period is lowered, the more sensitive the indicator becomes. If you are interested in knowing the formula it looks like this:

%K = 100[(C – L14) / (H14 – L14)]

C is the current closing price

L is the low of the last 14 bars

H is the high of the last 14 bars

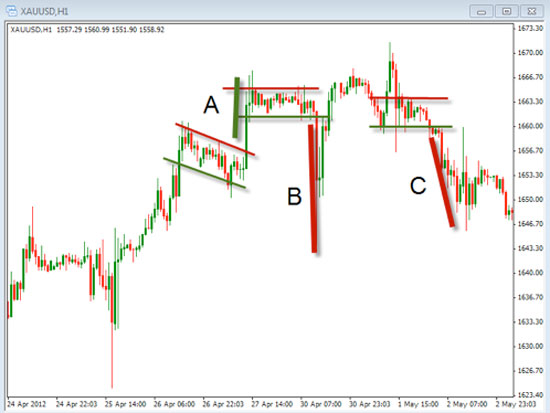

The number 14 is used as an example. This can be any number of time periods you would like to use. In the chart example below you can see an example of 3 different time period of the stochastic indicator. The top is the 5 period, the middle is the 14 period and the bottom is the 50 period time frame. Notice that the shorter term (5 period) stochastic is much more sensitive than the longer term ones.

The idea of using the stochastic indicator is to help us identify the momentum that is currently happening on the price chart. The way that we read the stochastic indicator can be varied depending upon what we are trying to do. One of the most common way is to look for the indicator to enter into the areas of overbought or over sold. This can give us an idea of when the price may be slowing down or beginning to reverse the current direction. In the chart below you can see an example of what happens when the indicator enters these areas.

Notice the red vertical lines show where the price has entered the Over Bought areas and the black lines show the Over Sold areas. When the price moves into the Over Bought area look for the price to slow the upward momentum and when it enters the Over Sold area look for the price to slow the downward momentum. Although it does not guarantee the price will change direction, it is a good indication of where things may slow down. When you use this in conjunction with the trend it can give you an even better idea for how things may move.

Take some time to review and practice using the Stochastic indicator to see if is can help you in your trading.