In April 1956 the first ship of its kind departed the dock at Port Newark for the Port of Houston. It was the Ideal X—the world’s first container ship.

That ship loaded with steel boxes was the brainchild of self-made transportation tycoon, Malcolm McLean. He watched the inefficient process of loading and unloading individual cargo and realized that sealing cargo into standardized containers increased the amount of cargo carried with much less handling required. Ships bearing the name of his company, Sealand, can now be seen on all the oceans of the world.

You may be wondering what this story has to do with trading. Just like the efficient container cargo ship which uses standardized containers for very efficient and profitable shipping. If we can think of trading with many small fixed risk trades using a system with very defined and repeatable entry and exit rules and specific risk management rules. We will have more efficient and profitable trading in the long run.

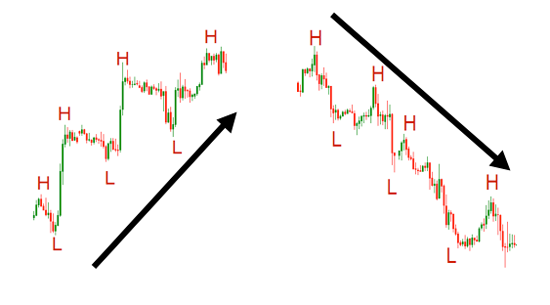

One big problem with many traders (especially newer traders) is the constant desire to find the “perfect system.” This leads to continually moving from one system to another without ever really getting consistent results from any of them. There is no perfect system, it doesn’t exist, no matter what the ads say. When a trader stops looking for the “Holy Grail” and starts actually trading a solid system with a good track record consistently, we increase our chances to be successful, as opposed to constantly trying new systems and never letting one method work.

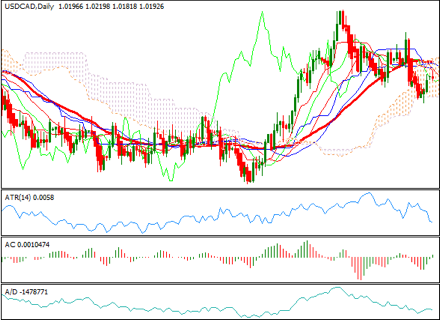

Risk management is also a critical element of any successful traders system. With good risk management we are more likely to control the emotions that come with trading and put ourselves in a better position to be profitable. Like the many containers on the ship, many small trades spread our risk out, instead of putting too much money into fewer, larger positions which may go against us and put our entire account at too much risk. Keeping our position sizes small with only 1-2 percent risk per trade will keep our individual positions small and our risk at an acceptable level. By placing stop losses on each and every trade, we can limit the risk per trade. In addition to small position sizing we should limit the total trades we have at any one time to 5 or so positions which will never allow our total risk to exceed 10% at any one given time, even if all of the positions go against us all at once. We need to live with the possibility each time we trade that each trade could be a loser; therefore, we need to be aware of the specific percentage risk we take with each position.

Just like the consistency that the fixed size containers brought to the shipping industry, consistency using a specific method and using specific risk management rules is the key to successful trading, The trader that sticks to a specific set of rules has the best chance of success, like the container ship, we too can reach the port of our choosing by having many trades with a fixed risk which can add up to our total trading success.