A very common theme that I see among traders, especially Forex traders, is that many of them seem to believe that you need to hit a homerun on every trade. I fully understand the need and the desire to hit the occasional homerun but every trade doesn’t have to be huge winner. One thing that I have finally begun to appreciate in my own trading is consistency. The big moves in the markets will come and we will be able to capture many of them but consistently making a steady profit is just as important and in many instances even more important.

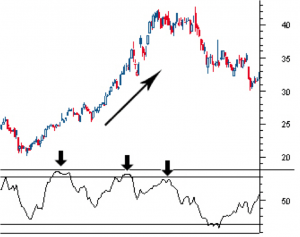

When you take a position in a given market you have a 50/50 shot at success because whatever market it is will likely go up down. It may go sideways for a time but that won’t last forever, the markets trend in one direction or the other roughly 70% of the time. Picking a long or short position is of course a start but what if you can find something that occurs in the market somewhat regularly just before it goes up or down. This is similar to what gamblers call a “tell” which is something a gambler will do consistently when they are bluffing or possibly when they have a good hand. The point is can we detect something that occurs regularly just before a market moves, does the market have a “tell”?

Interestingly enough the answer to this question of course is yes the only question becomes how accurate is it. It will certainly need to be better than 50/50 but we really can’t make much money at or near 50/50 unless our wins were larger than our losses. This is possible though it is very unlikely to be consistent. What if we can detect moves in the market with an accuracy of 60/40 or 70/30 or better. Now we may be getting somewhere but it is still very common to see traders with a pretty good method that has a decent winning percentage but they still break even or lose money. This is where the part about trying to hit too many homeruns comes into play which in a way may also be looked at as greed to an extent.

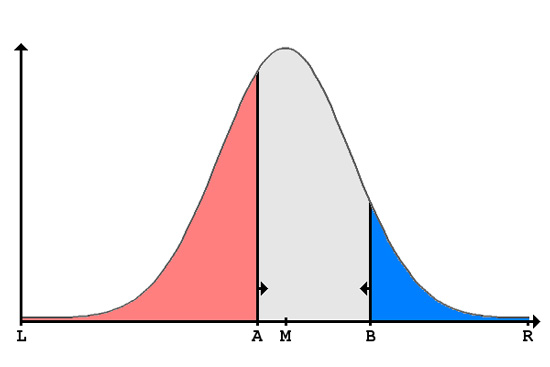

We cannot control the markets, though it would be nice if we could, nor can we necessarily expect regular big moves that our methods detect. If we have a method that we determine is 65% accurate with a return of 80 pips in the Forex market or 15% in the stock market, which isn’t too bad, what happens if we reduce our profit objective on each trade. In looking at a good sized population of trades that we make based on our method list the trades in order from highest to lowest by the amount that the trade went in the money before reaching our protective stop. It is entirely likely that many of the losing trades were in the money before the market turned around and stopped them out which will be very important to know. Next to this list starting at the bottom of the list make different levels in 10% increments showing the percentage of trades that went in the money by at least that level. The highest percentage of wins level, the 100% section, will show the lowest return but it will show at what level you can always win at. After we do this all we need to do is to go down the list to determine what percentage of trades made it to an acceptable level meaning that if we reduce our profit target by X% the accuracy of our method increases by X%.

If we can reduce our profit target to a still acceptable level while increasing our winning percentage we will begin to trade with much more accuracy and much more confidence. How would it be to place a trade order and enter into a position knowing that we will win 85% of the time or greater? As long as we are able to keep our risk/reward ratio in check we almost have to trade consistently profitably.

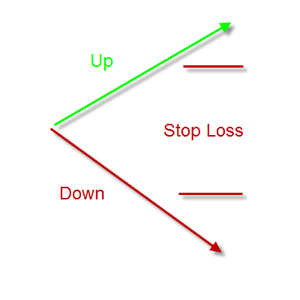

We can also go through this same exercise the other way looking at how far out of the money our trades go before they win which will tell us on average how far our initial stops need to be away from our entry points. We may determine that we are able to keep our stops allot tighter than we thought while not giving up that many trades. There will be trades that just don’t work out and are losers from the beginning which are the ones we want to end as quickly as possible, this exercise may make it easier to see those early on allowing us to exit as soon as possible minimizing the damage to our accounts.