So today I would like to discuss a bit about the much talked about and highly anticipated topic of QE3. Many people have heard of this but few people actually know what it is all about. The basic ideas is that the Federal Reserve has several way it can use to stimulate the economy and one of those ways is quantitative easing. This is the practice of purchasing securities in order to put more money into the economy which tends to lower the long-term interest rates. Once these interest rates are down, investors are more likely to spend money and expand business. This expansion in business is good for the economy and can help to improve the jobs market.

In addition to this latest round of quantitative easing, we have had 2 other recent times where this same process has taken place. The first was in November of 2008 in response to the financial crisis and the second in August of 2010. The goal was that each of these would provide the needed stimulus to the economy but since things have not improved as expected this last round of easing was just announced.

This last announcement that was released stated that the Fed would do two things to try and help the economy. It stated that it would keep short-term interest rates at these low levels until the mid part of 2015 and that it would be buying billions of assets each month until the end of the year. The main difference this time is that these purchases will more of an open ended deal.

So what does this all mean? Well, as traders, anytime the Fed takes action we generally see the markets move quickly and strongly. This can lead to some good trading opportunities but can also bring problems to traders who are not prepared. Let’s take a look at what happened to Gold and Silver as this announcement was made.

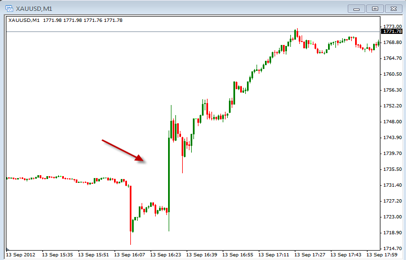

Take a look at the 1 min. chart below of gold and how the prices moved quickly and how the volatility increased dramatically.

Notice that the arrow points out the approximate time that the FOMC Announcement was made. The initial reaction was for the price to move down, followed by a sharp move up which continued for the next couple of hours. Now take a look at the daily chart below of Silver. Notice that the reaction moved the price of Silver higher and continued with the bullish direction it has been moving.

Remember that whenever the Fed speaks, the markets usually move. As traders we need to be prepared by know when they are talking and what we need to do to protect our positions first, then how we can benefit from these moves second. Whether you trade or wait it’s up to you, just make sure you know what you are doing and don’t let the market dictate your reactions.

In the end Gold and Silver are very bullish so continue to look for opportunities to take advantage of these moves. Once the price begins to show signs of weakness look for the market to retrace a bit. Until then, continue to look for long positions.