The election is over and Obama has won a second term. So what does that mean for us traders? Or for that matter, what does that mean for investors in general? For me the financial chaos in the world continues to get worse, principally because there’s no political will, whether in the United States or in Europe to control the exploding debt load. Of course we’ve seen the consequences in Greece when they’ve attempted to cut back on entitlements causing riots, looters in the street, general panic. Why? Because the Greek government is being pressure to curtail entitlements and get their budget deficit under control. This is very politically unpopular. Once you give people something and then try to take it away, they’re going to be very unhappy. In the United States we have the same situation. As a percentage of GDP our total debt is about 100 percent, 16 trillion dollars. That’s about a little less than the situation in Greece. The only big difference here is we have a printing press called the Federal Reserve. They can print dollars whereas the government in Greece cannot print Euros.

So what does all that mean? It means that the debt will continue to spiral out of control, running deficits of over a trillion dollars a year. Obama has shown zero inclination to do anything about that. He’s shown zero leadership to do anything about it. Of course he’s not alone. He’s got many politicians in the Congress who have no inclination to do anything about it. So this is going to continue to put a big drag on the economy. It’s not unlikely that we will have another recession, even though I believe we’ve never really exited the last recession. Interest rates will continue to be manipulated to zero or very low levels by the Federal Reserve. Hope against hope that somehow the economy will restart itself and grow us out of this mess. That’s just a pipe dream; it’s not going to happen.

Once interest rates do increase, because the Fed won’t be able to hold them down forever because the market won’t put up with it; the market will not perpetually buy U.S. Government debt forever at these very, very low rates. So when the market rejects the U.S. debt at these low rates, rates will rise regardless of what the Fed tries to do. When that happens, if we aren’t already in a second recession we will be then.

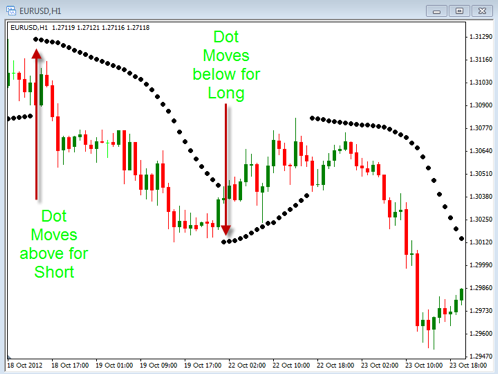

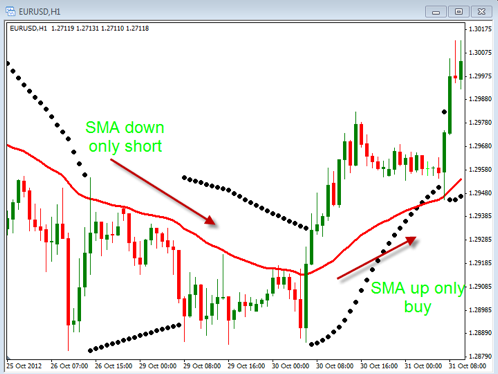

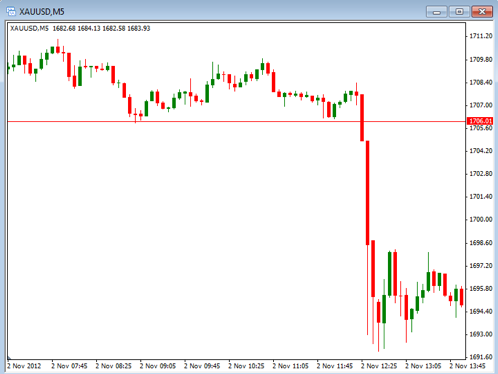

Now, for investors that’s a pretty gloomy outlook. For investors in this environment there are not a lot of good choices. When I’m talking about an investor, I’m talking about somebody who buys and holds, has a diversified portfolio and hopes that the diversification will protect them from the vagaries of the marketplace. Stocks go down, bonds go up and they’re safeguarded. In this environment that absolutely offers no protection. And so what are left to do? My view is if you’re not already a trader, a short term swing trader, you better learn how to become one real quick, because you’ll need to do so at a minimum to protect yourself. These markets are unforecastable. We don’t know when the dollar is going to collapse. We don’t know when the bond market is going to collapse. We don’t know when the stock market is going to collapse. But as a short term trader, you don’t care. You’re not invested for the long term. What you’re doing is you are going with where the market wants to go in the short term. So that protects you on the one hand. On the other hand, it allows you the opportunity and the potential to rack up some very impressive profits.

So you go from one extreme to the other. You go from desperation as an investor, scared, worried, what’s going to happen tomorrow, I don’t know, how’s this going to impact my 401k? You go from that to, hey look, I’m going to go with wherever the market wants to go and I’m going to take advantage of the profit potential that short term trading, swing trading, has to offer. So this is a new world, this is going to be this way for a long time. So don’t think it’s going to get better here in another year or two because it isn’t.

These are very serious structural problems that are going to take a long time to work through. So we can thrive in the meantime. We don’t have to be worried, don’t have to be concerned. We can thrive. How do you do that? You need a good trading method, or good trading advice. Then you can successfully take advantage of the short term swings of the market up or down while protecting your capital from risk all the while.

So the bottom line for me is be not the investor, be the trader, be the short term trader. And you’ll be very, very happy and you’ll be able to sleep at night. And you will go from borderline panic and fear to absolute control over your financial future.