Well this week we heard from the President in the State Of The Union message. We also heard the rebuttal from Marco Rubio on behalf of the Republicans. No matter which side of the aisle you’re on, in my opinion, you heard nothing new. The President continues to support big government, believing in big government solutions to our economic problems. Marco Rubio on behalf of the Republicans continues to support free enterprise and limited government. Neither one supported their statements with data.

The political scene these days is all about feelings. President Obama, delivered a very fine speech (in terms of style) as he always does, but it’s full of feelings and no data. A lot of those feelings feel good. It sounds inspiring; it sounds like what he’s proposing is going to help the economy. On the other hand, Marco Rubio in his rebuttal was also appealing to the feelings of immigrants, harkening back to the days when immigrants would come to this country, make a life for themselves without government support and do just fine, graduating from the underclass so to speak to the middle class, which was an amazing accomplishment. That still happens today with many, many immigrants. They are not afraid to work and do well in spite of the economic headwinds.

But neither side can present a compelling case for their argument supported by data. I should say neither side will provide such data. It’s a shame because if you look at the facts, and set aside the ideology, whether it’s liberal or conservative, you might end up actually coming up with solutions that work.

Now what does that all mean for our investments? Well, I didn’t hear anything in Obama’s State Of The Union message that signaled anything different when it comes to government spending other than perhaps more government spending. So the Federal Reserve will be compelled to continue to buy Treasury Bills, bonds and mortgage backed securities to the tune of $85 Billion a month and now maybe even more if some of these new programs that President Obama wants to initiate actually occur. So that means the deficit spending in all probability will continue unabated. This is what is really important for us investors.

Regardless of whether you’re conservative or liberal, Republican or Democrat, the fact is deficit spending is continuing unabated and at a potentially increasing rate. So the Federal debt will now continue to climb at a trillion or more a year.

Now that of course, has the effect of undermining the dollar as we’ve said many times. The message this week from the President is none of that’s going to change. So that means the dollar will continue to lose value gradually as it has been doing but at some point you’re going to see inflation increasing, gradually at first but then quite dramatically.

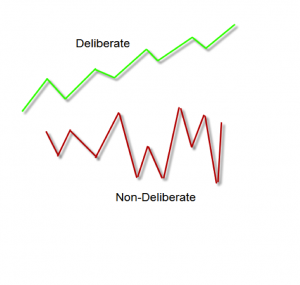

What does it mean then for our investment positions? It means the money that the Fed is pumping into the system has to go somewhere and part of it is going into the stock market, and the market is going up. As investors, we don’t really care too much why it’s going up, it’s just going up. So you want to be there; you want to be invested in that market. Now it’s overbought right now. It looks like it’s going to top and correct down. But even when it does, and it will here in the next few weeks, it may be very brief. Then you could very well see another rally into the seasonal high in April.That’s the way it looks right now so in keeping with our philosophy, we want to go where the market tells us it wants to go, not where we think it should go. Right now it’s telling us it wants to go up. So you need to be considering long positions, buying at the right price, not just jumping in at any old price, and then using good risk management principles, protecting your positions with trailing stops.

Now at some point the market will peak out. It could be this summer, or it could be sooner. Then it could drop significantly. But following our discipline with the trailing stops you’ll be protected locking in profits all the way up and then as the market rolls over it may be appropriate to consider short positions. That remains to be seen. I’m just pointing out what a possible scenario could look like here in the next several months.

That’s it for this week. Everybody stay disciplined and we’ll talk to you next week.