Stop losses are essential when it comes to our trading. Without the use of stop losses we open ourselves up to uncontrolled loss potential. With the use of stop losses we can control the amount we are willing to risk in our account. The use of a stop loss is essential to proper position sizing as it tells us the amount we are risking in a single trade. Knowing where to place the stop loss is just as important as actually having one. Today we will look at some places where we might consider placing our stop losses when we enter into a trade.

The following are areas where we might consider placing the stop loss.

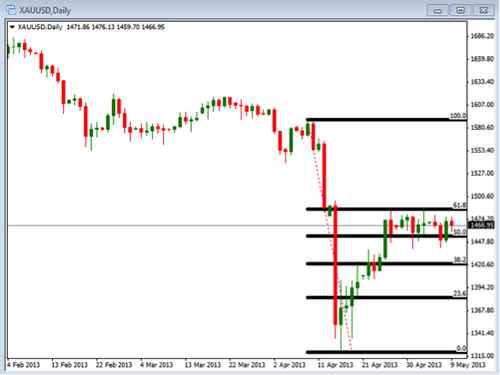

1. Support and resistance – Knowing where the support and resistance areas are located can give us an idea of where the stop losses should be set. These areas are where price will generally experience buying or selling causing the price to resist continued movement. Take a look at this chart below as it shows where we might place stop loss.

In this example you can see the resistance line that is drawn with the stop loss placed just above this area. This is where you might decide to place your stop if you shorted gold at this point. If you took a long trade and bought gold you would identify the area of support and place your stop just below that area.

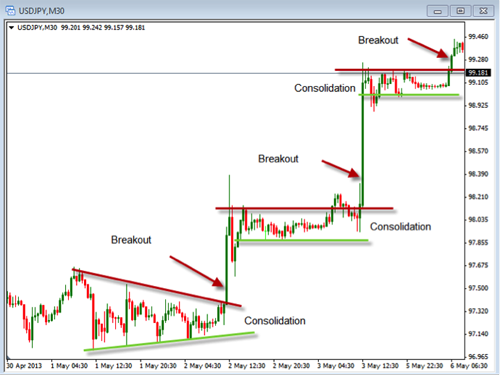

2. Moving Average – Moving averages give us an idea of the direction the price has been moving but can also be used to identify where our stops should be placed. Take a look at the chart below to see how this might work.

In this example you can see that we have placed a 40 period simple moving average on the chart of gold. As the trend is being established as up or down you can look to place your stop loss above or below the moving average. In this chart you can see that the trend is moving down and we have identified places where we might consider place our stop loss.

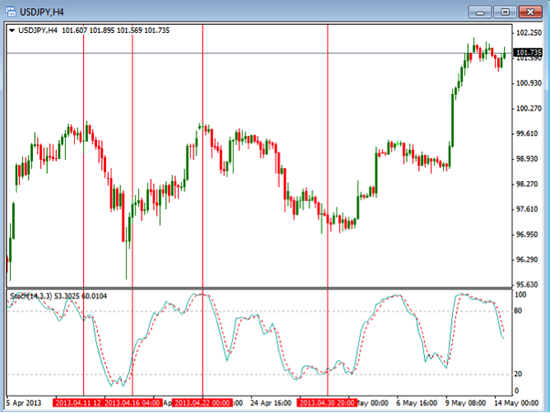

3. Prior Swings – When looking to place stop losses we can use the prior swing high or low as a point of reference. The goal would be to exit the trade if it takes out these prior areas. Take a look at the chart below.

In this chart you can see we pointed out the last swing low and where we might place the stop loss below it.

Regardless of how you place a stop loss you should know what you are going to do before you place the trade. In addition to placing the initial stop you should know how you are going to adjust your stops as the price moves in a favorable direction. Of course we should never move our stops further away from our trade but it is ok to tighten them up in order to lower the amount of risk we have in the trade. Using a trailing stop can help us in our overall risk control.

Take some time to review what you are doing and where you are placing your stop losses. Make sure you are comfortable with how you decide where to place them.