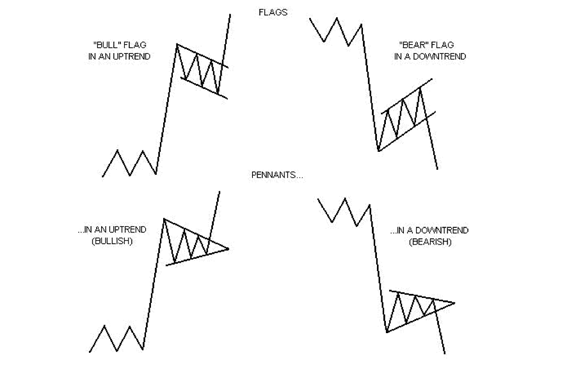

Last time we discussed some chart continuation patterns, such as flag and pennant price patterns to identify the continuation of a trend in the market after a minor reversal or pullback. Today l will discuss price patterns that can help you identify a potential change in direction from the current trend. These patterns are often referred to as market reversal patterns. While these patterns do not always show up in every market reversal, when they do show up, they can be very powerful indicators of a weakening trend and the strong potential for a market reversal.

Double Top and Bottom Reversal Patterns

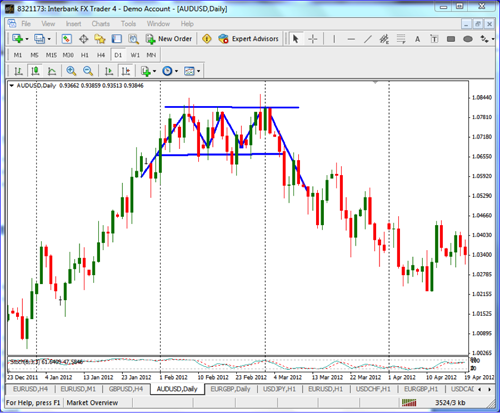

Double tops and double bottoms are fairly common reversal patterns. These are also commonly referred to as an “M” pattern, for the double top, and a “W” pattern, for the double bottom. A good example of a double bottom, or “W” pattern, can be found in the chart below of the AUD/USD forex pair.

Figure 1: Double bottom or “W” pattern on the daily AUD/USD forex pair.

Triple Top and Bottom Reversal Patterns

In addition to the double tops and double bottoms, we have a similar pattern that, when it sets up, can be a very strong indication, and even stronger than the double tops or double bottoms. A good example of a triple top is also found on the AUD/USD forex pair in the following chart. Note that once the support level at the bottom is broken, after three attempts of the price action to move higher, and it just doesn’t have enough momentum to move higher, it will often reverse and move lower. Also note, in the chart below, that as the market breaks the support level at the bottom of the pattern, the market will retest that old support, which now turns into new resistance before it reverses and moves on lower.

Figure 2: Triple top with price breaking below support.

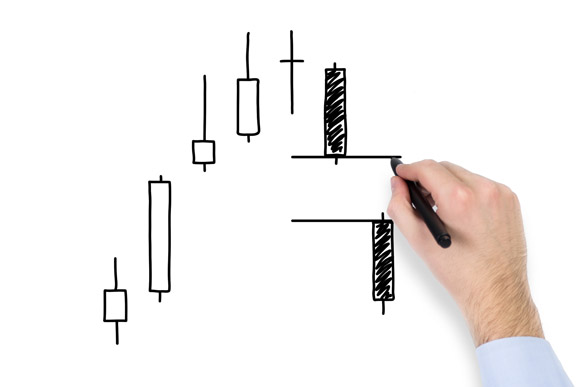

Head and Shoulder Reversal Patterns

The market is in a strong uptrend if you can see a head and shoulders pattern set up with two shoulders and a head, with a support line called a neckline, like the chart below on the EUR/USD. In a downtrend, the head and shoulders is generally referred to as an “inverted head and shoulders”. For example, the pattern found in Figure 3 below is an inverted head and shoulders pattern and is found at the bottom of a market, in a downtrend, and is opposite of the regular head and shoulders pattern, found at the top of a market. With an inverted pattern, the neckline is at the resistance level, at the top of the pattern. The head and shoulders pattern is similar to a triple top or triple bottom, but the middle peak is higher or lower than the shoulders level, setting up the head, the two shoulders and the neckline, as illustrated.

Figure 3: Inverted head and shoulders.

Conclusion

These reversal price patterns, including head and shoulder patterns, double top and bottom patterns, and triple top and bottom patterns, are useful to identify the possibility of a market reversal or, at least, a momentum shift. It is important to understand how these patterns rely on established principles of support and resistance. As illustrated in the charts, for the pattern to be complete, the price action completed and confirmed the pattern by breaking up or down through support at the top of the market or up through resistance at the bottom of the market. Watch for these patterns on the charts and use them to help indicate changes in momentum.