One of my biggest problems with being a successful trader and investor is getting me out of my own way; over the years, many other traders have told me that they have the exact same problem. Based on conversations that I have had with other traders and investors, both experienced and inexperienced, one common theme that seems to repeat itself is that a lot of trades are losers because the trader makes them losers. It isn’t necessarily that the trade setups are bad or not valid, and it isn’t that the market is doing anything to us, though sometimes it does seem as though it is against us. Often times, trades lose because the trader interferes with a good method and makes decisions around trades based on what they think they know, versus what they actually know. What traders typically find is that what they actually know is usually very little. So when trade management decisions are made, they aren’t always the best decisions and, in some cases, they can be very detrimental.

If we have a good, solid method for trading or investing, and we know that the method works a high percentage of the time, anything that we do that is outside of the parameters of that method is the same as saying that we know something about the market. We are essentially saying that we are smarter than our successful method, that we know something that the method doesn’t, and that we must be some kind of prognosticator that can predict what the market will do because our decisions in the moment are clearly better than what our proven method tells us to do.

If we are so smart and if the market’s direction is so easy to predict, there would be no reason at all for having a method or any kind of strategy or trading plan; we could simply enter and exit the market at will, pulling money out of it like it is the biggest ATM machine in the world. Since it does not appear as though that is the case for any of the, literally, thousands of investors and traders that I have spoken with over the past several years, it may make sense for us to reign in our egos and realize that we actually know very little about anything with regard to what direction the market will take. Internationally recognized economists, so-called market gurus, and professional traders, some of whom are on TV, some with their own shows, can’t get this stuff right. You can find just as many of these people that state that the market in general, a specific segment of the market, or a specific company’s stock is going to go up, as you can find that say the same thing is going to go down. Clearly, these experienced and well-educated people don’t have a clue as to what is going to happen, so what would make us, the average or typical trader, think that we have any better insight? Do we have a crystal ball? Is there anything in our past history of trading that makes us think that we are smarter than everyone else? In most cases, the answer to these questions will be an emphatic ‘NO’ or, at least, it should be a ‘no’. If any of us were so great at predicting where the market is headed, we wouldn’t be looking at this website or reading this article.

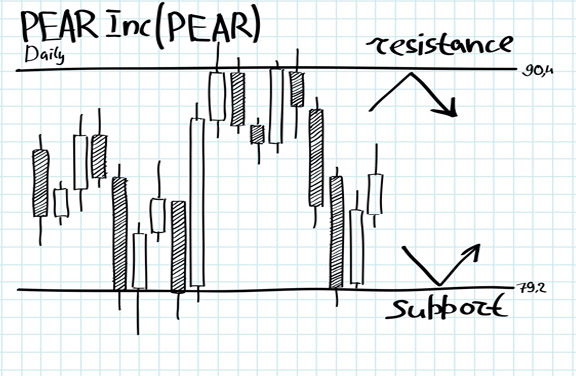

Once you have a method that has a high degree of accuracy or, at least, a level of accuracy that is acceptable to you, stick with whatever the rules of the method are, regardless of what you think may or may not happen. More times than not, trying to outthink an otherwise successful method will lead directly to losing trades. If most of us could be successful without a good method, we wouldn’t create trading methods. So if you have a good method, don’t go around it; be disciplined and follow it exactly as it was created until you see some flaws or that it doesn’t work as well as it did in the past, at which time, make the necessary adjustments to get back on track. Either find or create a good trading method and stick with it or abandon any thought of a trading method and just jump in an out of the market making random decisions, but don’t do both. You probably have a much greater chance for success by employing a proven method, so if that is what you decide to do, don’t ruin it by being undisciplined and going against what you know to be successful.