Today we are going to discuss an indicator that is used a bit less than some of the other ones we have looked at in the past. The Parabolic Stop and Reverse, or the PSAR, is and indicator that has many different functions when placed on the chart. One of the most common ways to use this indicator is to reverse your position when the indicator changes. You will see that the indicator plots a “dot” either below or above the price on the chart. If the trend is moving up, the dot will be below the price and if the trend is moving down, the dot will be above the price. So as the dot moves from above to below or below to above, you would enter the trade in that direction. Another simple way to use the PSAR is to use it as a trailing stop area. Each time a new candle shows up, the dot will be adjusted. You would then simply move the stop to the area of the new dot.

Now that we have described these two ways of using the Parabolic Stop and Reverse, let’s take a look at how they look on the charts.

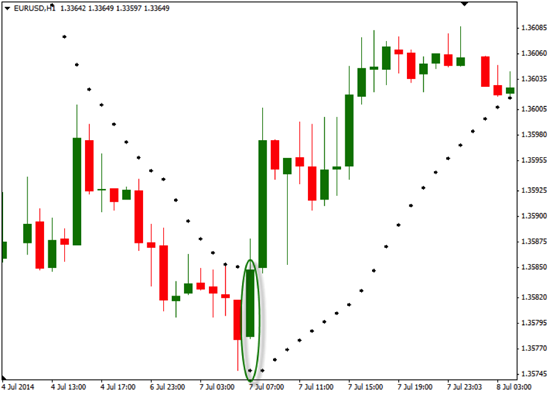

In this chart below, we are looking at the 1-hour chart of the EUR/USD. Notice how, when the price is trending down, the PSAR dots are above the price and, when the trend is moving up, that they are below the price. In this case, if we were looking for a possible entry into this pair, we would have taken a long position on the close of the candle where the dot moved below the price. You can see the green circled area where this happened.

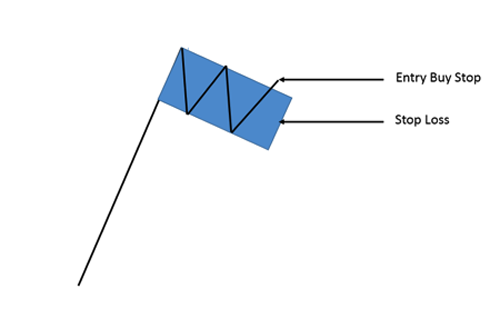

As the price begins to turn down, we can look for the dot to move above the price, suggesting a place to enter a short trade. In the next chart we are showing how the PSAR can show us where to place the initial, then trailing stops.

As we see new dots formed, we can place our stop loss at those levels. You can see that as the price moves up, the PSAR will follow along. Using this to exit will generally give you a good place to put your stop, as it will not be so close that you get stopped out in regular price movements. Once you are stopped out, you will begin to look to enter the trade in the opposite direction. Many traders like this type of stop, as it gives them a specific place to put the stop loss. In addition, it is dynamic to the price movements on the charts, so it gives us a place to trail the stop loss.

As with any indicator, you will want to test it out to see if it will help you in your trading. Take some time to practice with it to see how it will work best. Whether you are using it to look for potential entry points or you are looking for something to help with your stop losses, the PSAR is a good tool to have.