Wouldn’t it be great if you could look at a stock chart and know for sure that the price was about to go up?

Of course, that’s every trader’s dream. It’s what every newbie and experienced trader alike are on the hunt for every single day. It’s also one of the most difficult things to do.

And while it’s impossible to predict what a stock is going to do 100% of the time, there are 3 telltale signs anyone can exploit to increase the odds dramatically of knowing when this is about to happen.

In this short article, you’re going to learn these 3 signs, along with 3 specific techniques you can copy to help you predict when a stock’s price is about to rise.

To begin, one of the most difficult things for any trader is to try and determine when a particular stock has ‘bottomed’, or reached its low point and may be headed for an upward trend.

Of course, everyone wants to buy low and sell high, but if you consider that a stock’s price can be influenced by many variables, such as macroeconomic, political and economic events, being certain that a stock has bottomed is an intimidating task.

Unfortunately, there is not a realistic expectation that you are going to find a way to know for sure what the price will do in the future. Always keep in mind that “expect” is the key word here; no one knows for sure if a stock will move higher.

You need to fight through all the information, noise, hot tips from media personalities, or friends (who themselves are just guessing).

Without discipline, risk management, sound trading methods, and some useful trading tools, you may as well be gambling in a casino.

First, you have to determine your trading time frame: short-term (20 days), intermediate-term (18 weeks) or long-term (18 months).

Depending on your time frame, you can use the following charts:

- Short-term – Daily

- Intermediate-term – Weekly

- Long-term – Monthly

The first requirement, in reviewing the charts, is that the stock must already be in an uptrend; trying to pick the bottom of a downtrend is foolhardy. This requirement, paired with using simple techniques, which I’ll get into below, can help you identify stocks that are very likely to move higher.

With that being said, there are some very useful tools that you can place on your charts to have a reasonable expectation that the price should continue to move higher.

Many traders make their trading decisions based on subjective information, whether it’s from them guessing or having a “gut” feeling or they are listening to what someone else thinks may happen.

One of the most important things you can do as a trader is to develop a process of objective criteria in your trading. This objective criteria gives you a definitive way to say something is happening on the chart, without having to guess.

As a trader, if you can create a step-by-step process of evaluating your charts, you can begin to gain the confidence and consistency you need to make your trades.

So what are some of the more objective things you can look at to decide if a stock is going to move up in the future?

Here are three things that you may want to start using to help identify if the price wants to move up:

Telltale Sign #1: Price Action

This might be the most simple, yet effective, way to identify if price is going to move up. Price action is the key for all other indicators. If there were no price action, the other indicators would be useless.

The first thing you can look at is to make sure that price is making higher highs and higher lows. The stock will not rise if this doesn’t happen.

Each bar has a bar-high, as well as a bar-low. As these highs are on the increase, you can see price action rising.

One way to confirm that the price is beginning to trend up is to look for an initial move in the price action, from making lower lows and highs, to making higher highs and lows.

For example, once the price action has put in 1 higher swing high and 1 higher swing low, you can be fairly confident that the new trend is forming.

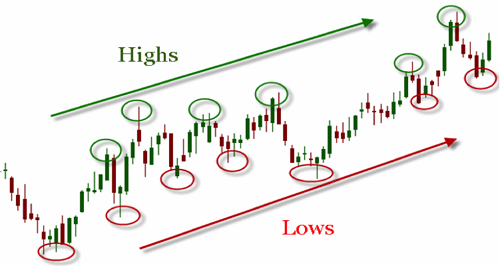

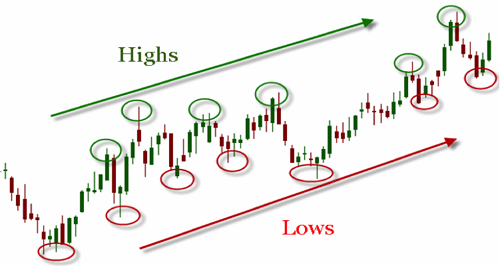

Take a look at this chart below:

In this example, you can see the red and green circles, which outline the highs and the lows, both moving higher. When we see this type of price action, we can feel comfortable in stating that the price should continue to move higher.

In addition, if the price changes from this pattern, to now making lower highs or lows, you can know that the direction is beginning to change.

Copy This Technique:

An excellent buy point occurs in an uptrend when the market retraces 50% of a previous up move. To determine that level, you take the most recent high and add it to a previous higher low and divide by 2. That will give you the 50% retracement level. Strong support often occurs at the 50% retracement level where the uptrend then resumes.

|

Win More Trades Than You Lose By Eliminating This 1 Thing?

There are things you do when you trade that absolutely sabotage your chances of building wealth. We call these the “Profit Killers”, & there are 7 of them. Our free, 15-second quiz will reveal your #1 “Profit Killer”, & then show you how to fix it.

Click Here To Take The Quiz To Discover &

Fix Your #1 “Profit Killer”

(A new window will open so you won’t lose your place on this page.)

|

Telltale Sign #2: Moving Averages

This is another simple tool that you can use to help you know if price is expected to rise. Moving averages come in a variety of types: simple, exponential, and weighted, to name a few. In the example below, the simple moving average is being used. This will give you an idea if the price is trending up or not.

A simple moving average can be calculated by using the open, high, low or closed price. In this example, we will use the closed prices.

So, in order to calculate the 40-period moving average, you would add together the closing prices of the past 40 bars and then divide by 40. This creates the average price over that time period.

It shows you if those prices are increasing or not. While this does not guarantee that the price will go up, it is a good indication that the market wants the price to stay strong.

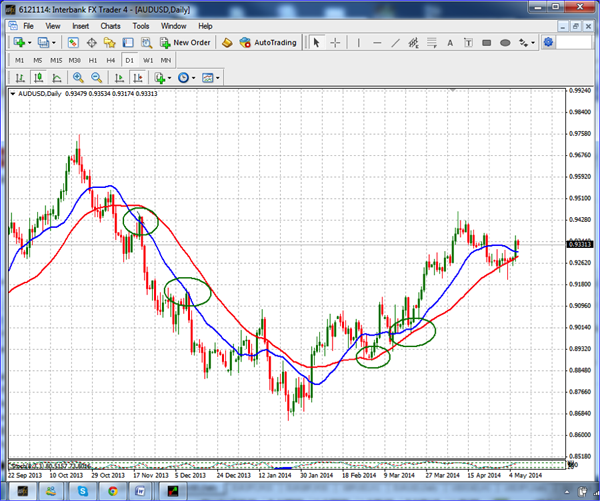

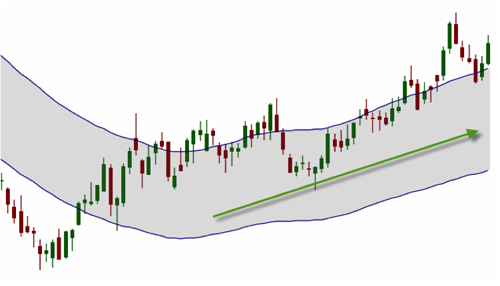

Take a look how this chart shows the red, 40-period, simple moving average moving higher:

This indicates that the price is strong and is likely to continue rising, at least in the near future. Also notice that the price is above the moving average. This is added confirmation that the trend is strong.

Once the price moves below the moving average it may be indicating that the trend is weakening and you need to look for something else that is going to continue moving higher.

Copy This Technique:

When the 40 simple moving average is moving higher, an ideal buy point would occur when the market retraces to the 40 simple moving average line and then closes higher than the previous bar’s high indicating that the stock will probably resume its uptrend.

Telltale Sign #3: Envelope Channels

This is a tool that can help you better visualize the direction the price wants to move.

Envelope Channels are percentage-based envelopes, set above and below a moving average. The moving average, which forms the base for this indicator, can be a simple, exponential, or front-weighted moving average.

The top and bottom channel lines are plotted the same percentage above or below the moving average. This creates parallel bands that follow price action.

With a moving average as the base, Moving Average Envelope Channels can be used as a trend following indicator.

If the channel that the envelope forms is moving upward, then the price is likely to continue to move it the bullish direction.

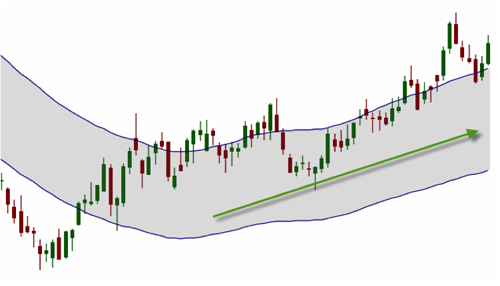

Take a look at the chart below to see how an envelope looks on the chart:

In this example, we have it set using the 50-moving average with a standard deviation of 10. You can make adjustments to these numbers, just be careful that you don’t customize it too much to make it look like you want.

This gives you a good visualization of the direction the price wants to move. An upward moving channel will represent a bullish moving stock.

As this channel changes direction, you need to be careful about continuing in a bullish trade.

Copy This Technique:

A high probability place to buy into an upward trending envelope channel is when the market falls back into the envelope to the center point, which is the moving average that the envelope is based upon.

Next Steps…

So there you have it! Whether you use price action, moving averages, or envelope channels, the key is to have an objective tool that will keep you from guessing what is happening. You should be able to look at the chart and have instant confirmation that the price action is strong and should continue to rise or not.

If you can trade when the price is likely to rise, then you are putting yourself in the best position to profit from that trade. Test out these telltale signs for yourself, copy and implement the techniques, and see how they can help improve your trading.

However, there’s a caveat to all this.

Even if you master these telltale signs and get really good at predicting when a stock’s price is about to go up, chances are that there’s something you’ve been doing in your trading that’s been unintentionally sabotaging your chances of having the potential to build real wealth in your portfolio.

It’s something that makes it almost impossible to consistently get ahead in the markets. I call these things the “Profit Killers”, and I’ve identified 7 of them.

But I also developed a free analysis tool that can pinpoint what your #1 Profit Killer is in about 15 seconds. Once you discover what it is, then it’s easy to eliminate it. And once you do that, your chances of winning more trades than you lose can skyrocket, almost immediately.

Go here to discover your #1 Profit Killer and learn how to eliminate it forever.

The

The

The dollar fell quickly and for quite a long time in the

The dollar fell quickly and for quite a long time in the