Today we are going to discuss a bit about trading during the news. This is something that every trader will have to deal with as news, both financial, political, and other types of news, is constantly being released. Because of this constant news coming out, we will need to know how to approach our trades so the effects of the news are minimized.

For example, this week we have a couple of major news releases coming out. First, we have the FOMC statement and interest rate coming out on Wednesday, followed by the nonfarm payroll employment changes on Friday. These are two fairly significant reports that will be release, so we need make sure we are prepared for the possibility for strong, or increased, volatility.

As with most reports, the market will have an estimate or forecast for what it thinks the number should be. If the report comes out better or worse than the forecasted number, we can expect to see that the volatility will increase. If the number comes out at the forecasted number, then we may not see a lot of movement. With the FOMC number, it is sometimes followed by a press conference, which can cause the effect to be even more extreme in its movements.

There are a couple of things that you will want to consider when trading during potentially higher volatility news releases. First, you want to make sure you are using proper risk management. This means that you should consider using a smaller risk percentage than normal. So, if you normally risk 2% per trade, you would consider dropping it to 1% per trade. The next thing you might consider is to increase the amount of your stop loss. This might sound a bit more risky, but, in reality, if the price action becomes more volatile, we will be better off by giving the price a bit more room to move during these volatile times.

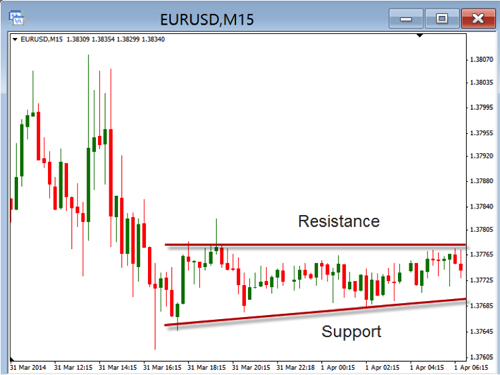

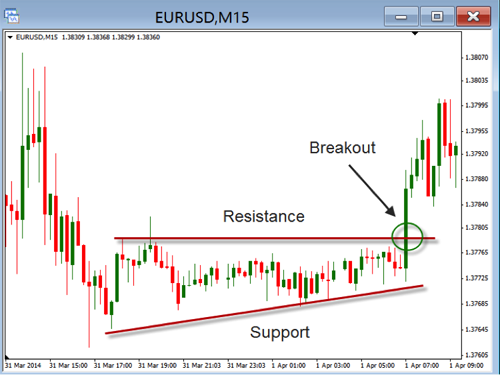

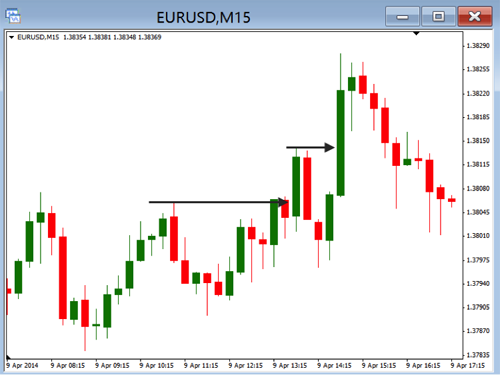

The other thing to consider is how to take advantage of this possible increase in price action. If we are expecting the price to move strongly one direction or the other, we can look to place a buy stop or sell stop above and below the current price. Doing this before the release of the news can allow us to take advantage of the big move. If we are trying to catch the big move up or down, we really don’t care which way, we only want it to move a lot. As we look to place the entry stop orders, we need to remember that spreads can widen enough that we could get filled before the announcement is actually released. This would put us into the trade prior to the move actually happening.

As you approach the news you can practice in a demo account to see how the price action is affected by the news. Take some time to see how this might be a time where you could place some trades and see big moves in your favor. Just remember to use good risk management and to practice before you try it in your real account.