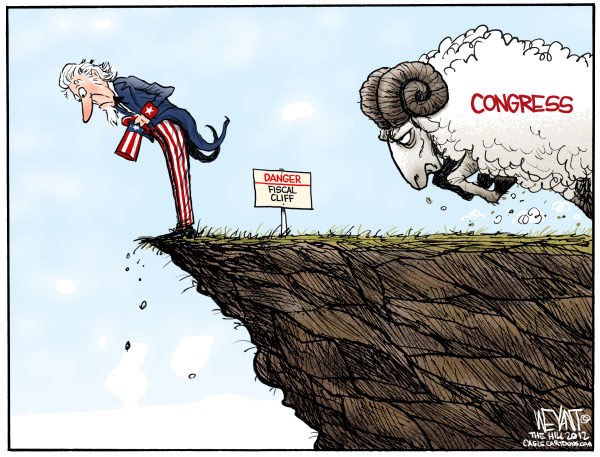

Today we are going to talk a bit about the idea of “Myopic” trading and what it means to Gold traders, or any trader for that matter. You may ask yourself, “What is Myopic trading”? Well, let’s first start by defining what the word myopic means.

MYPOIC = nearsighted, shortsighted, unwilling to act prudently, narrow-minded, lack of understanding.

This should give you an idea of what this word means. We could probably add other terms to define this but I think these define it well enough for what we need. As we add this word to “Trading” hopefully we can see some problems that might arise. As traders, if we become “Myopic” in our trading or in other word shortsighted, we can run into many different problems.

It does not matter if you are trading Stocks, Options, Currencies or Forex, Futures or Gold and Silver this can be a problem for any trader. As a trader looses sight of the “big” picture they can become near or shortsighted in their decision making process. As we become so focused on one aspect of our trading we can miss seeing what is really happening.

For Example, some traders will want to be in a trade so bad that they will avoid seeing the obvious things that would keep them out of a trade and only see what they want to see to get the into the trade. They may look only at a specific indicator, like the stochastic indicator, and see that it is moving up so they buy. They won’t look at or the avoid looking at all the other things that might tell them to stay out. So even though the trend is down and they are sitting at resistance and there is news coming out and it has just been downgraded they will still buy it because of one thing they see.

The other issue with being myopic in our trading is that we end up holding onto trades that we should be closing out. Again, even if everything is telling us that we should close the trade we will find the one thing that tells us to stay in it. This occurs often times when we enter a trade long and it move down and we are loosing money. We don’t want to loose the money so we hunt and find the one small thing that says we should stay in it, even if we have 10 major things that tell us to get out.

This is where having your rules clearly outlined and defined can help you. Understanding and knowing all your rules for entry can keep you from becoming a myopic trader. Take time to review what you are currently doing to see if you have developed the bad habit of trading myopically. If you have, go back and review your process for deciding when to take a trade and for getting out of a trade. Make sure you are aware of the possibility of myopic trading and if you find yourself avoiding the obvious things, stop and reassess your decisions. Looking at the big picture will help you to make the right decisions in your trades.