Often times when talking about trading currencies, our thoughts turn to the shorter-term types of strategies. While this may be where many traders focus their attention, there are longer-term types of trades that can be looked at also.

Longer-term trades can be reached by either looking at longer-term time frames or by adjusting our indicators to longer parameters. By changing our time frame from the 1, 5 or 15 min charts to the 1, 4 hr. or daily charts, we are changing the time we are allowing the trade to work. Instead of minutes we begin to look at hours and day for the trade to develop and work out. By changing the parameters on our indicators we extend the distance between our entries and our exits. So instead of looking at a 5 or 10 period simple moving average we begin to use the 20 or 40 period simple moving average. This adjustment will make the entries and exits come further apart and give us a longer-term perspective on our trades.

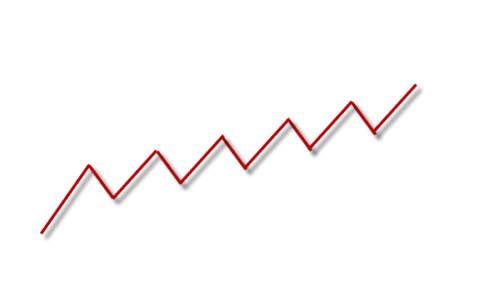

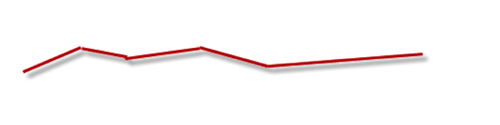

Take a look at the charts below. The first one shows the longer-term indicators while the second shows the shorter-term indicators using the same Daily chart. If we were looking to trade these by using the crossovers of the two moving average lines you will see quite a bit of difference.

On the top chart, you have a 20 and 40 period Simple Moving Average, while on the bottom you have the 5 and 10 period Simple Moving Average. As you look at these two charts you should be able to see that the longer-term one on the top gives fewer signals than the shorter-term one does on the bottom. Or, in other words, the crossovers happen more often on the shorter-term indicators.

The same would hold true if we looked at differences between the 5 min. chart and the hourly chart. You would get more trades by using the shorter time frame. This may be fine, but as a new trader or one learning a new way to trade, you may want to focus on taking trades using the longer-term charts. So instead of having to look at the chart every 5 min. for a possible setup, you are looking for setups on an hourly basis. This give us time to review the entry and to make sure it is meeting all the setup conditions necessary to take the trade.

So, if you are having difficulty finding and trading setups on your shorter-term charts, consider using a longer-term chart. Start by looking at the 4-hour chart and moving down from there. The 4-hour charts give plenty of time to see the setups and to allow you to make entry decisions while at the same time giving you plenty of pips to collect without the stress of having to babysit it minute by minute. You may find that the 4-hour charts fit perfectly into what you are trying to do.