Choosing a broker is one of the most important decisions you will make as a trader. Without a broker, you will not be able to trade; therefore, this decision should not be made lightly. There are many good brokers available, so you will need to take the time to identify which of these will be best for you. The best broker for you is the one that gives you all the tools you need to trade successfully. Don’t rely on other traders to tell you which one to use, as they may have other trading needs than what you have. Take the time now to choose the correct one for you and you will be happy in the long run.

So what makes a broker a good one? Well, most brokers will have all the basics you need in order to place a trade. You will likely find they are similar in entry and exit orders, as well as placing a basic stop loss. The important thing for you to look at is what they have beyond these basic and common features. You will want to look at your trading methods to make sure you can place a trade based off your rules. If they do not have your needed features, you will want to pass on them as your broker.

With this in mind, let’s discuss some of the more important points to consider when deciding on a broker.

1. Are they regulated?

This is an important place to start, as you will want to avoid brokers who are not regulated. There are enough risks associated with trading that we do not want to add more by trading with unregulated brokers.

2. Commissions

How much are you going to pay when you place a trade? This is an important point because it can directly impact your bottom line. The more we pay for commissions, the less we will make.

3. Executions

You will want to make sure your trades get executed fast. If they are slow, you will likely get a poor fill and will not be happy with the entry price. It may be worth paying a little more in commissions if you are getting better fills. You can test how fast your broker fills are by practicing in their demo account.

4. Support

You will want to test out their support help. Call them and ask questions. If you speak to them and they are unfriendly or just don’t seem to care, you will want to cross them off your list. Good customer service is critical when it comes to helping you resolve issues you might have.

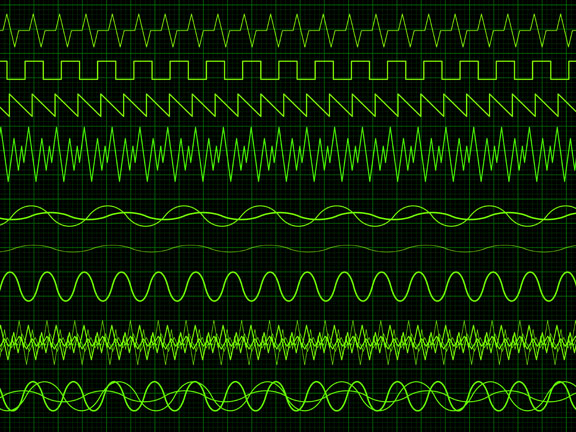

5. Trading Platform

Do you like the charts and are they easy to use? Can you easily access the area where you will be placing a trade? Do the charts have all the tools and indicators that you will need to use to trade your method?

6. Order Executions

Can you place the types of trades you will be using? If you need conditional orders, you will need to make sure they have the capability to do so. If you need trailing stops, are they available and do they work?

7. Funding

How are you able to fund your account? Do you need to do a wire transfer or send a check? You will want to make sure you can add or withdraw funds simply and quickly.

8. Demo Account

You will want to be able to practice in a demo account. This is a great way to test out the broker and to practice new methods as you expand your trading strategies.

9. Other Markets

Will you be able to trade other markets like stocks, options, forex, futures, bonds or ETFs? You might not need these now but you may in the future.

10. Appearance

How does the platform look and do you like to look at it? This might seem insignificant, but if you have to look at it every day, you will want to make sure you like it.

As you begin to look for a broker, make sure you take the time to evaluate each one in detail. Doing this at first will save you the frustration of having to change at a later time. Remember, what works for another trader might not work best for you. Take the time to review these things and use them to help you in identifying the best broker for you.