Today I want to discuss a commonly looked at and used price pattern called the head and shoulders pattern. This price pattern falls into the category of a reversal pattern. A reversal pattern is one in which the price action that has been occurring is likely to reverse the direction. These reversal patterns typically occur after a larger move in one direction a happened. Once these patterns have been formed you would look for a major change in the direction of the price.

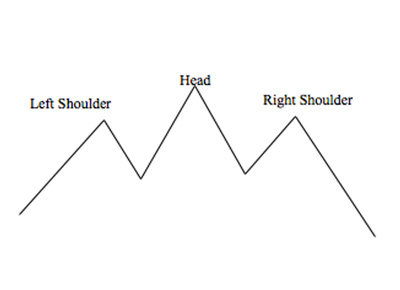

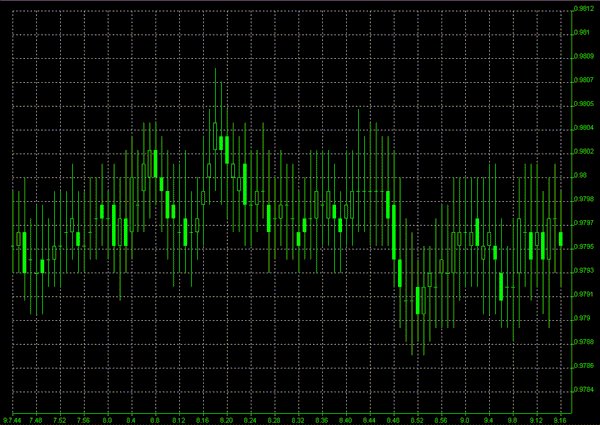

In order for the head and shoulder formation to occur you will see the price make a pattern that looks like a head with a shoulder on either side of the head. In theory the price pattern should look something like this picture below.

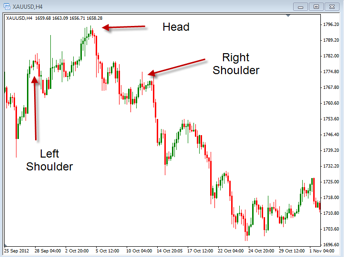

The first part of this pattern in created by making a swing high that creates the left shoulder followed by another higher swing high creating the head then ending with the lower swing high forming the right shoulder. This is a textbook picture of the head and shoulders pattern but may not be what is seen normally in the real market. Compare the picture above with the actual market below to compare what it might look like in reality.

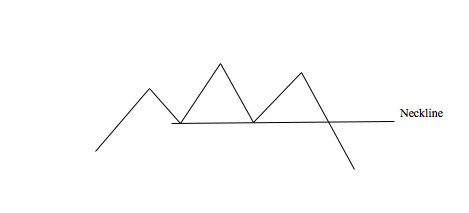

So you can see that there is quite a bit of difference between the actual chart and the theoretical chart. When you are looking for these you need to be able to pull the price pattern out of the chart. Even though they may not look exactly like the drawn picture above, you will occasionally find some that look pretty close. Finally, in order to know when to enter a trade you would wait for the price break below what is called the “neckline”. Notice that the picture below shows where this would be located.

Once the neckline is broken you can set a target the is the distance between either the left shoulder and neckline or the head and neckline. Remember, this is a price pattern that can give us an idea that a change may be coming. But, we do not trade it until the neckline is broken to confirm the reversal is happening. Take some time to review this pattern and see if it can help you better identify times when the market is likely to reverse.